India’s Balance of Payments (BoP) slipped into a deficit of $16 billion in the January-March quarter of FY22. In the preceding quarter, however, there was a surplus of $0.47 billion and there was a surplus of $3.4 billion in the fourth quarter of FY21.

The previous time India’s BoP was in the deficit was 13 quarters back i.e. the December quarter of FY19 with $4.3 billion. Also known as the balance of international payments, BoP is a statement of all transactions between entities in one country and the rest of the world over a period of time.

The BoP comprises both the current account, which includes net trade in goods and services and net earnings on cross-border investments, and the capital account, which includes transactions in financial instruments and central bank reserves.

The CAD is the shortfall between the money received by selling products to other countries and spent to buy goods and services from other nations.

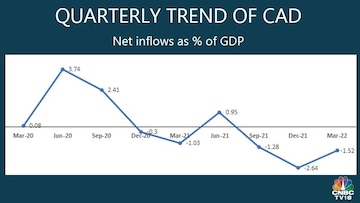

The CAD is the shortfall between the money received by selling products to other countries and spent to buy goods and services from other nations.For the fourth quarter of FY22, India’s current account deficit (CAD) declined to $13.4 billion from $22 billion in the previous quarter. But it jumped more than 60 percent from $8.1 billion in the fourth quarter of FY21.

A widening CAD can be inferred as an imbalance in the economy, leading to implications on the domestic currency. For FY22, India's CAD stood at $38 billion, the highest since FY19 of $57 billion. The rise was owing to a strong inflationary environment, which led to a rise in the value of imported goods of $189 billion, the highest since FY13 of $196 billion when crude oil prices were at $108 per barrel, similar levels as today.

Kavita Chacko, a chief economist at Edelweiss Wealth Management, expects India’s CAD to widen in FY23. “It could be in the range of 2.6-2.8 percent of the gross domestic product in the ongoing financial year. This has implications for the Indian rupee. The weakness in the rupee is to prevail and expect the move in the range of 77.5 to 79 over the next 2-3 months,” Chacko said.

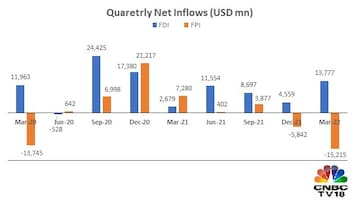

The foreign portfolio investors also withdrew $15.2 billion in the fourth quarter of FY22, higher than the $13.7 billion outflows witnessed in the same quarter of FY20 when India underwent its first COVID-induced lockdown and the Nifty saw lows of 8,000.

In FY22, the two initial quarters witnessed marginal FPI net inflows, while the subsequent quarters saw a reverse trend of net outflows. Net FPI outflows totalled $16.8 billion in FY22 versus net inflows of $36 billion in FY21. On the contrary, FY22 net inflows of foreign direct investment (FDI) stood at $38.6 billion, of which one-third was received in the last quarter.

What do these numbers mean for the Indian economy

First Published: Jun 29, 2022 12:30 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM