Prices of various commodities and services ranging from LED lights to hotel room rates will increase from July 18. This change comes after rate hikes were approved at the two-day 47th GST Council meet on June 29. The meeting was held in Chandigarh and was chaired by Finance Minister Nirmala Sitharaman.

No decision was taken on extending the compensation window to states. The next Council meeting would be held in August.

Here is what will become more expensive:

-The GST rates of solar water heaters, some leather goods, textile works, will go up from the present 5 percent to 12 percent.

-Printing and writing ink as well as LED lights will now be taxed 18 percent from the present 12 percent.

-Hotel accommodation below Rs 1,000 per unit/day will be taxed at par with others at 12 percent.

-Hospital rooms, except for ICU, with daily rent of Rs 5,000 will be taxed 5 percent without input tax credit.

-GST rates on e-waste is increased from 5 to 18 percent

-Exemptions from cheques, lose or in book form withdrawn and are to be taxed 18 percent.

-Unroasted coffee beans, unprocessed green leaves of tea, wheat bran, de-oiled rice bran to be taxed 5 percent GST.

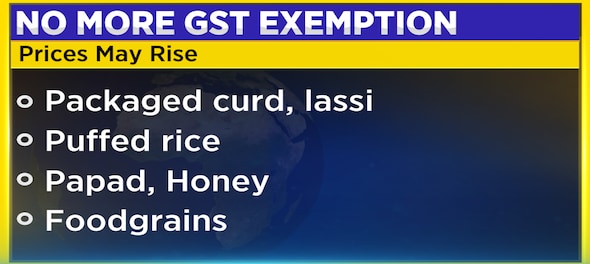

Exemptions accepted for withdrawals

-The GST Council accepted the GoM's view to withdraw GST exemption from packaged curd, lassi, buttermilk, flattened rice, puffed rice, parched rice, papad, honey, cereals, jaggery, food grains, certain vegetables

-Reinsurance of exempted insurance schemes

-Transport of passengers in business class from airports located in northeast states

-Transportation of magazines, newspapers, railway equipment by via road, vessel, rail.

-Services provided by SEBI, services by RBI, IRDA to insurers

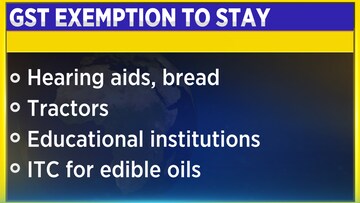

Here are the list of GST exemptions that will stay:

First Published: Jun 29, 2022 6:17 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM