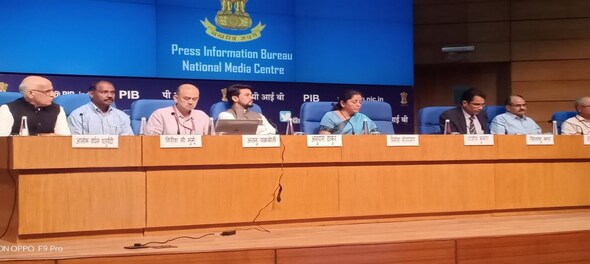

Finance Minister Nirmala Sitharaman on Friday announced that the government proposed to cut corporate tax rates to 22 percent for domestic companies provided they will not avail exemptions or incentives and 15 percent for new domestic manufacturing enterprises as part of a raft of measures to boost economic growth. here is how some important sectors will be impacted.

Capital goods and durables

At a time when investments were being deferred and capex addition had hit a multi-year low, the tax cut proposal from union finance minister Nirmala Sitharaman is expected to lend a fresh vigour to asset creation. The timing of the tax cut is critical as it comes ahead of the festive season and in the backdrop of the realignment of the supply chains globally.

Incidentally, multinational companies like ABB and Siemens currently fall in the higher tax bracket of 32-36 percent and stand to gain the most. Some domestic capital goods major like Thermax and Engineers India (EIL) have a current effective tax rate of over 35 percent, while for Larsen and Toubro (L&T) and Cummins it stands at 30 percent.

The move will not only directly impact the bottom line of the companies but would also spur demand which is expected to boost the sagging topline growth. The measure will provide more room to corporates to invest in net asset creation which in turn will have a multiplier effect on the economy.

While the impact of increased capital expenditure in infrastructure will have a longer lead time, analysts believe that for sectors like consumer durables the impact would be visible in the upcoming festive season itself.

The consumer durable companies will have a bigger room to provide incentives and discounts to dealers and customers as the net profit margins are expected to expand. The expansion might be loftier for the likes of Whirlpool, CG Consumer and Havells as they currently fall in the tax bracket of 30-35 percent as compared to Voltas and Blue Star, which pay taxes at the rate of 17-22 percent currently.

Pharmaceutical companies

The effective tax rate cut is going to benefit the pharmaceutical companies. Companies that have a 100 percent domestic focus or a majority domestic focus will benefit more. The case in point for this would be Dr Lal Path Labs. The diagnostic company pays a tax rate of around 35 percent. It is expected to probably reduce by 9 percent to around 26 percent.

The other example would be a lot of the multinational companies (MNC) focused pharmaceutical companies which derive majority of their revenues from India. GlaxoSmithKline, which pays around 35 percent in terms of a tax rate is probably expected to see its tax rate reduced by around 10 percent. Similar case for the other such as Pfizer, Sanofi etc.

In terms of the other companies however, it depends on the proportion in terms of the US business as well as the kind of R&D incentives etc. For example, Cipla, Aurobindo Pharma probably pay taxes anywhere between the range of around 22-27 percent. Within this entire gamut, Sun Pharmaceuticals is one of the lowest taxpayers at around 15 percent in terms of a tax rate. So the biggest beneficiaries from this particular tax cut would definitely be the domestic focused pharmaceutical healthcare companies but the other companies such as Cipla and the others would benefit as well.

IT companies

When you look at the tier-1 IT companies, the only company that is likely to benefit is Infosys which pays a tax rate of about 26-27 percent.

For all the other companies, whether it is Tata Consultancy Services (TCS) which pays a tax rate of 24 percent or others like Wipro, Tech Mahindra, HCL Technologies, the tax rate is lower than 25 percent.

Secondly, the reversal in the dividend tax. The two companies which could benefit are Infosys and Wipro. Both of them had announced their buyback prior to the budget. They have completed the buyback but they have not paid it. For Wipro, the buyback amount was Rs 10,500 crore. So on that, a 20 percent tax would mean a saving of about Rs 2,100 crore. For Infosys, the buyback amount was about Rs 8,260 crore, so that is about Rs 1,600 crore of saving.

FMCG companies

The tax cut is important for the FMCG sector primarily because most of the companies have their effective tax rates upwards of 30-35 percent.

Benefits of the tax cut announced by FM would be three-fold for the FMCG Sector:

Oil PSUs

The tax cut is a positive surprise for oil PSUs as there was an expectation of a divestment announcement.

The sector is reeling under a lot of taxes. Infact, recently ONGC in its annual report said that taxes on domestically produced oil is limiting its earnings performance. The upstream companies pay a hefty tax, especially Oil India that has a tax rate of 40 percent and is expected to benefit the most. ONGC has an approximate tax rate of 33 percent.

The oil marketing companies will also benefit post this move. Remember, they have also been trading at 40 percent below long-term averages and approximately 25 percent below global peers. Therefore, the tax cut will definitely give some valuation support.

Similarly, gas majors will also get some breathing room as the average effective tax rates in the sector is around 33-35 percent. It’s important to note that these companies are charged with a lot of indirect taxes such as cess, royalties and excise duty as oil and gas sector is still not under GST. Reliance will see minimal gains, as they are pay 28 percent tax and thus the effective gain will not be big.

First Published: Sept 23, 2019 9:57 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: All you need to know about EVMs and VVPAT; how they work

Apr 20, 2024 1:24 PM

Odisha Lok Sabha elections: Schedule, total seats, Congress candidates and more

Apr 20, 2024 11:39 AM

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM