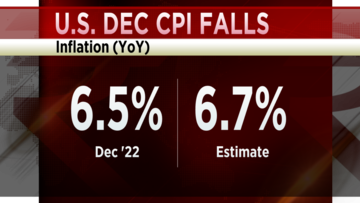

The global and the Indian macros appear to be changing for the better. Overnight the US December Consumer Price Index (CPI) fell by 0.1 percent from the November level which was on expected lines. The India December CPI came in lower than street expectations.

The big question which the economists are now asking is that if the US central banl, the Federal Reser will step down from its 50-basis point rate hike at a time to 25 bps rate hike at a time in February. In India, the question is, is the Reserve Bank done with hikes or done with one more hike only?

Robert Sockin, Global Economist at Citi, appeared on CNBC-TV18 to discuss the state of the economy in Europe and the United States. According to Sockin, the recession in Europe is "fairly shallow" and is expected to improve going forward. Sockin also commented on the probability of a "soft landing" in the US, stating that it has risen. He also noted that the dollar could gradually depreciate and that we can expect a "fairly shallow" recession in the US.

Additionally, Sockin stated that there are clear signs that inflation is slowing. He also mentioned that there is a fairly split opinion on whether the Federal Reserve would hike rates by 25 or 50 basis points in February.

“For the US, we still have a recession, the probability of a soft landing has gone up, even though it's not the base case. And in Europe, we still have a recession, but a fairly shallow one now and that situation is also looking better. So, the news was good at for Asia, relatively speaking at the end of last year, and it has got even better since then,” said Sockin.

While talking about the US recession, he said, “We still hold that the US is going to go into a recession later this year, we have it in the second half. The story there is really that the amount of Fed tightening that they have done is going to bite later this year. And that is what is going to pull the economy into a recession, but it's going to be a fairly shallow recession.”

Meanwhile, Kaushik Das, Chief Economist at Deutsche Bank also appeared on CNBC-TV18 to discuss the state of the economy in India. According to Das, the core inflation will soften till April-June. He also stated that the inflation trajectory in India has surprised the downside. Das believes that it would be better if the Reserve Bank of India enters into a prolonged pause. He also noted that the reality is that the Consumer Price Index is tracking lower than the Reserve Bank of India's target by around 50 basis points.

Talking about inflation, Das said, “Our forecast was 5.76 for the month of December, so it has come exactly in line with our forecast, but the reality is that the October-December CPI average has been 6.1, RBI had 6.6. So, inflation is tracking 50 bps below RBI’s forecast. January-March RBI has given a forecast of 5.9. Our forecast is showing that it will be around 5.5 percent and by the end of March, the point estimate of CPI would be close to 5 percent. And for April-June, RBI has given 5 percent. We are getting a number of 4.3-4.4 average for April-June.”

For the entire discussion, watch the accompanying video