India is in a capex up cycle trend. The quick revival from the COVID-19-led slump has been backed by public investment, which has resulted in a rebound in gross fixed capital formation (GFCF) in FY22.

The ratio of GFCF to GDP (constant prices) rose to 32.5 percent in FY22. For FY23, the government has budgeted for a strong capex growth of 25 percent to Rs 7.5 lakh crore and has already achieved 27.8 percent (Rs 2.1 lakh crore) of the capital expenditure target in the first four months of the current fiscal.

Overall, the Centre’s capex rose by 62.5 percent year-on-year in the April-July period of the ongoing fiscal year, with roads and highways, railways and defence being the top three investment areas. However, the share of defence in total spending has come down over the years while that of roads and railways has increased.

However, state governments have lagged in their capex due to liquidity constraints during the pandemic years. Usually, their combined capex is higher than that of the Centre, but data for 27 states shows that in FY21 and FY22, the total capital expenditure by states fell below the Centre’s levels.

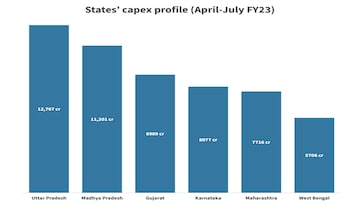

Rajani Sinha, Chief Economist at CareEdge, said, “Even in FY23, capital spending by the states has had a slow start due to the cessation of GST compensation and lower market borrowings by the states due to delays in the Centre’s approval”. Large states such as Uttar Pradesh, Madhya Pradesh, Gujarat, Maharashtra and Karnataka drove capex spending. States usually follow the wait-and-watch policy and accelerate capex only in the last quarter.

Capex by India Inc. shows signs of revival

A CareEdge analysis based on data for 659 listed non-finance companies shows capex by companies rebounded in FY22 with a growth of 22 percent (year-on-year), following a decline in FY21. However, it remained below pre-pandemic levels seen in FY19 and FY20 as businesses were cautious to incur fresh investments due to factors such as high inflation, muted demand, subdued business sentiments and an uncertain economic environment.

CareEdge expects the government schemes such as the National Monetisation Pipeline, Gati Shakti, and PLI to help in the recovery of the capex cycle in the economy. Rajani Sinha, Chief Economist at CareEdge, said, “While interest cost is rising for corporates, we do not see that as a big deterrent for the capex cycle.” The top five sectors in which capital expenditure was concentrated with a share of 63 percent in FY22 were telecom, oil and gas, power, retailing, iron and steel.

Way forward

As far as the private sector is concerned, there has been deleveraging in the last few years. Now with the capacity utilisation levels improving to 75%, the ground is set for pick up in the investment cycle. While the recent fall in global commodity prices and consequent easing of input prices are supportive of investment uptick, the volatility in commodity prices remains a challenge. While interest cost is rising for corporates, that is unlikely to be a big deterrent for the pick-up in capex.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Elections 2024: Can BJP repeat its poll success in Uttar Pradesh? Here's a SWOT analysis

Apr 17, 2024 7:47 PM

Lok Sabha elections 2024: Know what all is closed on April 19 for phase 1 polling

Apr 17, 2024 7:35 PM

Lok Sabha elections 2024: From Nagpur to Chhindwara, key battles in Phase 1

Apr 17, 2024 7:19 PM