In 1947, India's GDP was less than Rs 3 lakh crore. Today, it is over Rs 230 lakh crore. Its population of 1.38 billion people has grown four-fold and foreign direct investment has multiplied over 100-fold to $84 billion. That's just a glimpse of the scale of change the nation has seen in the past 75 years. Notably, businesses and markets have grown too, along with the economy.

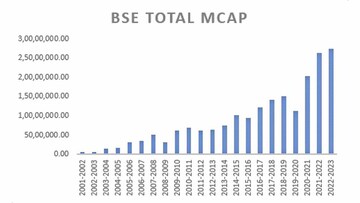

India's market capitalization (based on stocks listed on the BSE) has grown at a CAGR of just under 20 percent since 2002, while India's nominal GDP has grown at a CAGR of a tad over 12 percent during the same period. While market cap has expanded at a faster pace and the market cap to GDP ratio has risen from about 27 percent of GDP to over 100 percent of GDP over the period, one can't deny the contribution of economic growth to its expansion.

What this suggests, is that if the Indian economy can continue to grow at a healthy pace over the next 5-10 years, there is no reason to believe equities won't continue to reflect their past performance. Does this mean that the market cap to GDP ratio can expand further? Sure, it can. The US market scaled to 200 percent in December last year and now trades at about 150 percent market cap to GDP ratio. So, there's no rule against expansion, though this does seem lofty.

Compounders deliver

The other interesting facet of the 75 years of India's independence is how businesses spawned in pre-independent India or in early independent India have grown and retained their leadership positions. Did you know that The Indian Hotels Company was incorporated in 1902, Tata Steel in 1907 and ITC in 1910? These companies have been around for decades and have continued to lead their sectors. They have also created immense wealth for their shareholders. We pulled out a list of prominent listed companies incorporated before independence or in 1947 and we were surprised to find a big bunch of wealth creators.

Since it was tough to find historical price data for all these companies, we decided to evaluate their performance since when we could source corporate action-adjusted data. And what we found was compelling. These companies have delivered compounded returns of between 10 percent to 25 percent over the past 30 years. The BSE Sensex itself has delivered over 13 percent compounded returns.

| Company | Inc Yr | CMP | Date | Price | CAGR |

| Indian Hotels | 1902 | 271.8 | 1-Jan-90 | 2.69 | 15 |

| Tata Steel | 1907 | 112.65 | 1-Jan-90 | 4.92 | 10 |

| ITC | 1910 | 308.4 | 1-Jan-90 | 0.43 | 22 |

| Britannia | 1918 | 3659.45 | 1-Jan-90 | 14.83 | 18.2 |

| Tata Power | 1919 | 232.4 | 1-Jan-90 | 2.71 | 14.4 |

| Kansai Nerolac | 1920 | 493 | 1-Jan-90 | 1.93 | 18.3 |

| Berger Paints | 1923 | 676.1 | 1-Jan-90 | 0.43 | 25 |

| Bata | 1931 | 1912.25 | 2-Jan-95 | 74.53 | 12.3 |

| HUL | 1933 | 2595.2 | 1-Jan-90 | 7.26 | 19.5 |

| Cipla | 1935 | 1027.35 | 1-Jul-93 | 2.23 | 22.7 |

| ACC | 1936 | 2240 | 1-Jan-90 | 13.44 | 16.8 |

| Tata Chem | 1939 | 1119.7 | 1-Jan-90 | 22.2 | 12.6 |

| Asian Paints | 1942 | 3427 | 1-Feb-93 | 5.93 | 23.6 |

| Escorts | 1944 | 1683.15 | 1-Jan-90 | 84 | 9.5 |

| M&M | 1945 | 1259.7 | 1-Jan-90 | 6.75 | 17.2 |

| Tata Motors | 1945 | 477.5 | 1-Jan-90 | 14.61 | 11.1 |

| Wipro | 1945 | 436.15 | 1-Jul-93 | 0.32 | 27.2 |

| L&T | 1946 | 1844 | 1-Jan-90 | 13.17 | 16.2 |

| Exide | 1947 | 159.15 | 1-Jan-90 | 3.86 | 11.9 |

| Grasim | 1947 | 1622.7 | 1-Jan-90 | 19.48 | 14.3 |

| Piramal Ent | 1947 | 1919.95 | 3-Jan-94 | 56.69 | 12.9 |

| BSE-Sensex | 1986 | 59462.78 | 25-Jul-90 | 1001 | 13.2 |

What this suggests clearly is that sound businesses with a legacy of performance can continue to grow and thrive over time, making them safe, steady compounders for investors. So, when in doubt about where to invest, think of companies with strong, well-established, time-tested businesses. History suggests you won't go wrong.

Invest some money overseas

The other important takeaway from India's 75-year history of independence is that it pays not to keep all your money in one currency. Did you know that you could buy one US dollar for just Rs 3.3 in 1947? Today, you need to pay almost Rs 80 for the same dollar. That translates into a compounded annual appreciation in value of the dollar of 4.3 percent. So, a hedge with some investments in growth assets overseas can be a good option for your portfolio.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM