Agrochemicals manufacturer UPL Ltd. reported revenue growth of 21 percent from last year, led by strong traction in the Americas business and firmness in pricing.

The management has also reaffirmed that it will meet its full year revenue as well as operating profit or EBITDA growth guidance. It has also expressed confidence in reducing its net debt to $2 billion by March 2023.

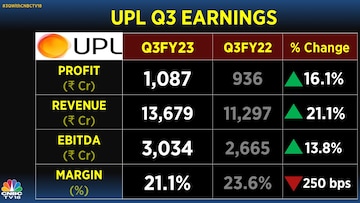

UPL reported revenue of Rs 13,679 crore, which was ahead of expectations of Rs 13,145 crore. Net profit was in-line with expectations. However, the company's EBITDA margin declined 250 basis points from the same period last year due to significant input cost pressures.

The company mentioned that the crop protection business grew 22 percent from last year, along with robust growth in the Advanta seeds business, which increased 31 percent from last year.

Operating profit or EBITDA growth of nearly 14 percent year-on-year was due aided by strong topline growth, and despite an increase in SG&A (Selling, General and Administrative) expenses.

Within geographies, the Latin America business grew 28 percent year-on-year led by strong growth in the insecticides business, particularly in Brazil. NPP BioSolutions and fungicides led growth in Mexico while Argentina business was aided by strong demand in herbicides.

North America business continues to grow in double-digits supported by strong commodity prices.

Europe continues to remain a headwind for the company. The low-single-digit growth was due to the devaluation of the Euro, ongoing conflict and products ban. However, in Euro terms, the business grew 10 percent year-on-year, despite the significant macro headwinds.

The management further said that the demand for agrochemicals continues to remain strong going into the March quarter, especially in the Americas. It expects strong volume growth during the quarter, even as some channel-deinventorying is taking place.

Shares of UPL ended 1.6 percent higher at Rs 756.85.

First Published: Jan 31, 2023 3:22 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: BJP's bid for breakthrough in Kerala is an uphill battle, say experts

Apr 23, 2024 9:53 PM

2024 Lok Sabha Elections | PM's Rajasthan speech — has it anything to do with the post-poll mood of the first phase

Apr 23, 2024 3:45 PM

It's KGF 2024 and here's a look at the key characters in Karnataka

Apr 23, 2024 3:17 PM

JP Morgan: Nifty may test 25,000 if BJP wins in 2024 Lok Sabha elections

Apr 23, 2024 2:23 PM