On the back of the best-ever price it earned on crude oil it produces, state-owned Oil and Natural Gas Corporation (ONGC) reported a record net profit of Rs 40,305 crore in the fiscal year ended March 31, becoming India's second most profitable company behind Reliance Industries Ltd. In a statement, ONGC said net profit for the fiscal FY22 (April 2021 to March 2022) soared 258 percent to Rs 40,305.74 crore from Rs 11,246.44 crore in the previous financial year.

This as it got an average of USD 76.62 for every barrel of crude oil produced and sold in the fiscal as against USD 42.78 per barrel net realisation in the previous year. This is the best ever price that ONGC got as international oil prices surged from late 2021 and spiked to a near 14-year high of USD 139 per barrel after Russia invaded Ukraine.

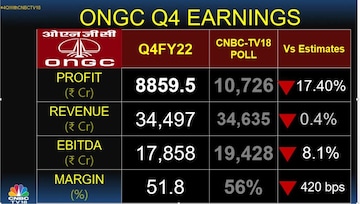

The net profit for the March quarter stood at Rs 8,859.5 crore as against Rs 8,764 crore in the previous quarter. The CNBC-TV18 Poll had predicted a net profit of Rs 10,726 crore.

Also Read

Revenue for the fourth quarter was at Rs 34,497 crore. It was at Rs 28,473 crore in the third quarter. The CNBC-TV18 Poll estimate was at Rs 34,635 crore.

International rates had spiked to a record USD 147 per barrel in 2008 but ONGC's net realisation at that time was much lower as it had to provide subsidies to fuel retailers so that they could sell petrol, diesel, and cooking gas LPG and kerosene at rates lower than cost.

ONGC now gets international rates as the downstream fuel retailers too price petrol, diesel and other petroleum products at global rates. The firm got USD 2.35 per million British thermal unit for the gas it sold as against USD 2.09 in the previous FY21 fiscal. The gas price jumped to USD 6.1 in April this year and this impact will be visible in the first-quarter earnings.

Consolidated net profit, after including those earned by its subsidiaries like HPCL, PL and ONGC Videsh Ltd, soared to Rs 49,294.06 crore in 2021-22 as compared to Rs 21,360.25 crore in 2020-21. Both standalone and consolidated net profit of ONGC is the second-highest profit in the country.

ONGC once was India's most profitable company but a decline in output and paying fuel subsidies led to its earnings declining over the years. ONGC said its standalone revenue from operations soared nearly 62 percent to Rs 1.10 lakh crore and consolidated turnover came in at Rs 5.31 lakh crore.

The profit surge was despite a 3.7 percent drop in crude oil production to 21.7 million tonnes in 2021-22 as some of the firm's western offshore fields were hit by a severe cyclone in May last year. Gas output fell 5 percent to 21.68 billion cubic meters. "The decrease in oil/gas production is mainly due to the impact of cyclone Tauktae in western offshore assets and western onshore assets and modification work at Hazira (Gujarat)," the statement said.

ONGC said its Reserve Replacement Ratio (2P) from domestic fields (excluding joint venture fields) was 1.01. This is the 16th consecutive year when ONGC achieved a Reserve Replacement Ratio (2P) of more than one. The company's overseas arm, ONGC Videsh Ltd reported a 16 percent drop in net profit to Rs 1,589 crore in 2021-22 as crude oil and natural gas output fell. Its crude oil production declined to 8.099 million tonnes in FY22 from 8.51 million tonnes in the previous year. Gas output fell to 4.231 billion cubic meters from 4.529 bcm in FY21.

ONGC declared a final dividend of 65 percent (Rs 3.25 per share of face value Rs 5 each), taking the total dividend paid in the fiscal to 210 percent (Rs 10.50 a share).

With inputs from PTI

(Edited by : Priyanka Deshpande)

First Published: May 29, 2022 12:17 PM IST