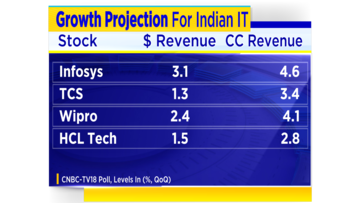

Indian IT companies are likely to experience steady revenue growth in the September quarter, according to a CNBC-TV18 poll. Revenue growth for the quarter is likely to range between 3 percent to 4.5 percent in constant currency terms.

Constant currency revenue means a fixed exchange rate that companies use to eliminate potential fluctuations while calculating financials.

Indian IT companies will begin the September quarter earnings season with TCS reporting results on Monday, October 10, followed by HCL Tech and Wipro on Wednesday, October 12, and Infosys, Cyient, and Mindtree on Thursday, October 13.

Among the large-cap companies, Infosys is likely to see the highest revenue growth of 4.6 percent in constant currency terms, while HCL Tech may have the lowest growth at 2.8 percent, according to the poll.

However, there is a divergence of nearly 200-300 basis points between the revenue growth in constant currency terms and revenue growth in US Dollar terms. This is largely due to the large currency movements witnessed during the quarter.

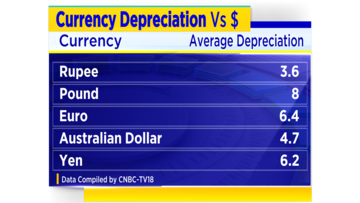

The Indian rupee depreciated 3.6 percent during the June-September period. While that is positive for IT companies, the depreciation of other currencies like the Euro, Pound, Australian Dollar and the Yen against the greenback will limit the US Dollar revenue growth for the companies.

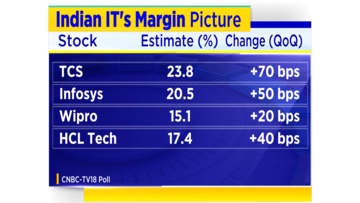

Although the currency depreciation will positively impact margins quarter-on-quarter, the quantum is likely to be limited due to the residual impact of wage hikes given to employees. Infosys hiked salaries of its mid and senior-level employees, while Wipro's hikes took effect on September 1 this year. Margins for companies like TCS could improve 70 basis points from the June quarter, while it may remain flat for Wipro.

The poll also suggests that Infosys is likely to retain its full-year constant currency revenue guidance of 14-16 percent while it may project margins to be at the lower end of its 21-23 percent range. Similar is the case for HCL Tech, which could retail its 12-14 percent revenue growth guidance while guiding for margins to be at the lower end of the 18-20 percent range.

Earnings for Indian IT companies come from Accenture's results last month, which guided an 8-11 percent revenue growth in constant currency terms. Broking firm Nomura stated that Accenture's guidance indicates softening demand for IT services.

Jefferies, which has also retained a cautious stance on the sector, is looking forward to commentary on demand outlook, nature of deals, pricing and attrition trends, and a potential buyback for Infosys.

After five consecutive years of positive annual returns, Indian IT stocks are headed for their worst performance since the Global Financial Crisis. The uncertainties have left the street divided on the future outlook for the companies. Most brokerages have downgraded the sector ahead of the earnings performance. Firms like Goldman Sachs believe that despite correcting over 30 percent from their peaks, the valuation of most Indian IT stocks remains on the higher side.

However, not all are pessimistic about the future of Indian IT. Macquarie believes that the fears about the stocks are overdone. In fact, its Asia unit has revised its cloud capex guidance higher.

What To Watch

All eyes will now be on the commentary from the management. Between the June and September quarter, most macro indicators in developed markets have deteriorated. Europe, which contributes to more than a quarter of overall revenue, is currently suffering from high inflation, cost pressures as well as geopolitical crisis with Russia.

Commentary on the BFSI vertical will also be keenly watched out for as half of the companies' topline comes from that vertical. This segment also gains more importance due to the crisis surrounding major banks like Credit Suisse.

Attrition will also be a key metric that will be looked at. Nomura expects attrition to remain at elevated levels for the next few quarters for Indian IT companies. The sector has also been in focus recently for employees who were fired for "moonlighting", and many of them not being onboarded despite receiving offer letters from companies like Wipro.

Despite the sharp valuation derating this year, most IT stocks are still trading at a 15-30 percent premium over their 10-year average price-to-earnings ratio.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Odisha Lok Sabha elections: Schedule, total seats, Congress candidates and more

Apr 20, 2024 11:39 AM

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM