InterGlobe Aviation, parent of the country's largest airline IndiGo on Friday, November 4, reported a loss of Rs 1,583.3 crore for the second quarter that ended September 30, 2022. In the corresponding quarter last year, the company posted a loss of Rs 1,435 crore.

Revenue from operations stood at Rs 12,497.6 crore during the period under review, up 122.8 percent against Rs 5,608.5 crore in the corresponding period of the preceding fiscal.

As of September 30, 2022, the airline has a fleet of 279 aircraft including 26 A320 CEOs, 149 A320 NEOs, 68 A321 NEOs, 35 ATRs and one A321 freighter; a net decrease of three passenger aircraft during the quarter.

For the quarter, IndiGo's passenger ticket revenues were Rs 11,1104 crore, an increase of 135.6 percent and ancillary revenues were Rs 1,2872 crore, an increase of 57.4 percent compared to the same period last year.

At the operating level, EBITDAR (earnings before interest, taxes, depreciation, amortisation, and restructuring or rent costs) stood at Rs 292.2 crore in the second quarter of this fiscal over Rs 340.8 crore in the corresponding period in the previous fiscal.

Also Read: Exclusive | Gogoro founder hopes to remove range anxiety with a mileage of 100 km per charge

The EBITDAR margin stood at 1.8 percent in the reporting quarter as compared to 6.1 percent in the corresponding period in the previous fiscal.

Pieter Elbers, CEO, said this is the second consecutive quarter wherein the company has operated at higher than pre-COVID capacity. In spite of a seasonally weak quarter, it saw relatively good yields with strong demand across the network. However, fuel prices and exchange rates have adversely impacted InterGlobe Aviation's financial performance.

He said the company is on a steady path to recovery, benefiting from enormous opportunities both in domestic and international markets. With an industry challenged by global supply chain disruptions, the company is working on various countermeasures to accommodate this strong demand.

Also Read: Kalpataru Power shares rise after company, subsidiary wins orders in excess of Rs 3,000 crore

As on September 30, the airline had a total cash balance of Rs 19,660.6 crore, comprising Rs 8,244.2 crore of free cash and Rs 11,416.4 crore of restricted cash.

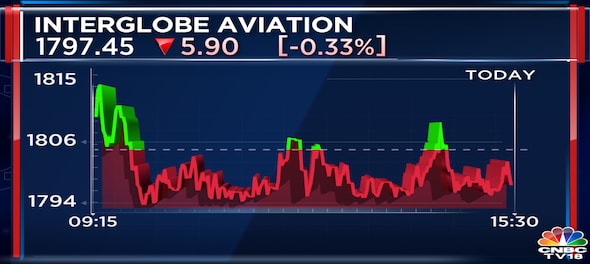

The results came after the close of the market hours. Shares of InterGlobe Aviation ended at Rs 1,797.45, down by Rs 5.90, or 0.33 percent on the BSE.

(Edited by : Shoma Bhattacharjee)

First Published: Nov 4, 2022 5:44 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Tamil Nadu Lok Sabha elections 2024: List of Congress candidates

Apr 18, 2024 4:33 PM

Will the payment under PM-KISAN be increased? Here's what Finance Minister said

Apr 18, 2024 3:58 PM

First phase of voting for Lok Sabha elections begins tomorrow, 1,625 candidates in fray

Apr 18, 2024 3:50 PM

Tamil Nadu Lok Sabha elections 2024: Full list of BJP candidates

Apr 18, 2024 2:37 PM