Indian Oil Corporation (IOC) is likely to post a 23 percent sequential rise in its revenue but it may suffer a huge loss and a margin cut for the April to June 2022 period, according to a CNBC-TV18 poll of analysts.

IOC will report its financial results for the first quarter of the fiscal and the Street was positive ahead of its earnings as its stock traded 0.7 percent higher at Rs 72.65 on BSE at 10:40 am.

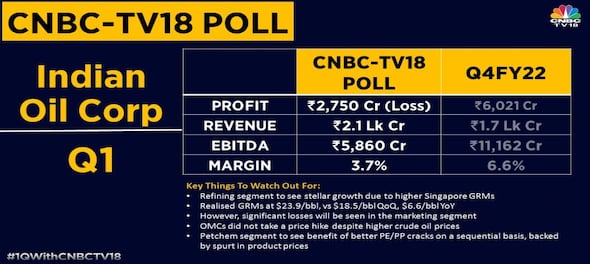

Analysts polled by CNBC-TV18 expect Indian Oil to report a 23 percent quarter-on-quarter (QoQ) rise in revenue to Rs 2.1 lakh crore, up from Rs 1.7 lakh crore in the previous quarter.

However, the state-owned oil and gas explorer and producer is likely to witness a loss of Rs 2,750 crore against a profit of Rs 6,021 crore in the last quarter of the 2021-2022 fiscal, led by “significant losses” in the marketing segment, they said.

Its earnings before interest, taxes, depreciation, and amortisation (EBITDA) is also estimated to shoot down to Rs 5,860 crore from Rs 11,162 crore, the poll suggests, while the margin is expected to almost 3 percentage points on a sequential basis to 3.7 percent.

This comes at a time when oil prices have been rising across the world, given tight supply concerns due to the geopolitical tensions in Russia and Ukraine. Oil marketing companies (OMCs), however, did not take a price hike despite higher crude oil prices during the three-month period under review.

Meanwhile, according to the poll, the refining segment of Indian Oil is likely to see stellar growth due to higher Singapore GRMs (gauge of regional gross refining margins — the amount that refiners earn from turning every barrel of crude oil into refined fuel products.)

It is likely to have realised GRMs at $23.9 per barrel veruss$18.5 per barrel in the previous quarter and $6.6 per barrel in the corresponding quarter a year ago, the poll said. The Petchem segment is expected to see the benefit of better polyethylene (PE)/Polypropylene (PP) cracks on a sequential basis, backed by spurt in product prices, it added.

First Published: Jul 29, 2022 10:31 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Every student suicide pains me, I will try better: BJP Kota MP Om Birla

Apr 16, 2024 2:19 PM

Bihar Lok Sabha elections 2024: Schedule, total seats, Congress candidates and more

Apr 16, 2024 1:02 PM

Lok Sabha polls: BJP drops Som Parkash, fields Abhijit Das against Mamata's nephew

Apr 16, 2024 12:49 PM