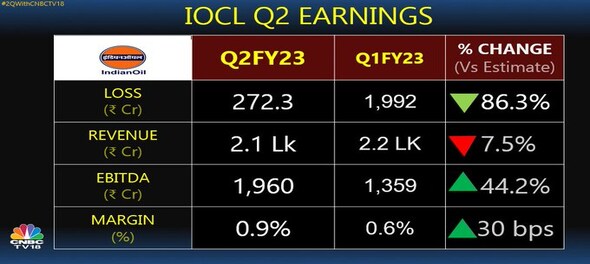

India's largest oil PSU, Indian Oil Corporation reported a net loss of Rs 272.3 crore on Saturday, down from a net loss of Rs 1,992 crore in the June quarter. Analysts in a CNBC-TV18 poll expected the company to report a net loss of Rs 14,476 crore for the July-September period.

The fuel retailing major IOC has used 50 percent of the one time grant of Rs 22,000 crore given by the government to compensate the three government owned oil companies on their LPG under recoveries.

Under recoveries is the gap between the cost and the selling price of fuel. In case the selling price is lower than the cost price, higher is the under recoveries. The grant is a first by the finance ministry as generalised subsidies for cooking gas have stopped and is being targeted only for the Ujjwala consumers .

This has helped the company sharply reduce its quarter on quarter net loss from Rs 1,993 crore during April-June to Rs 272 crore in the July -September quarter. Of course the Indian basket of crude oil too declined during the second quarter, from $105.49/bbl in July to $90.71/bbl in September.

But the company has still reported a net loss of Rs 2,265 crore for H1 April-September FY23 vs a net profit of Rs 12,300 crore in H1 FY22.

Given the price freeze on petrol and diesel sales since last eight months industry estimates an over one lakh crore under recovery on fuel and LPG , while the actual cash loss to companies is roughly estimated at Rs 50,000 crore.

The Petroleum Ministry said last month “Fuel price rise in India have been contained in comparison to exponential rise in developed countries. Most of the developed nations have witnessed significant inflation rise in gasoline price by almost 40 percent during July 21 to Aug 22, while in India, gasoline price has reduced by 2.1 percent."

Even on LPG front, in the past 24 months, Saudi CP price (our import benchmark) almost increased by 303 percent. During the same period, the LPG price in India (Delhi) increased by less than a tenth of that figure i.e. 28 percent”.

In this situation, there are no easy answers for the coming quarters. With inflation concerns topping the govt’s agenda and little fiscal room available after the deep cut in excise duties in May, pleas by the industry to cut excise specifically for the OMCs or allow a gradual pass through of prices are falling on deaf ears.

Industry says a 10-15 rs/litre price hike is needed on diesel and while under recoveries on petrol have stopped, a 1-2/litre price increase may still be required.

Before the OPEC production cut , there was an expectation that with crude oil softening , oil retailers maybe allowed some price correction. But with crude oil going back to over $90/bbl and September inflation imprint at 7.4 percent and state elections on the horizon , any hope of price increase for the OMCs have evaporated.

Industry is now hoping for price increases from next calendar, maybe even December, but this again may depend on the domestic inflation imprint, Brent crude price trend and also the political will . With the onset of winter in the West and a diesel supply crunch, demand and prices of the fuel are already soaring. So it’s anybody guess how the situation shapes up.

In case of a no-go on petrol, diesel price pass through or an excise cut limited to the OMCs - the government may have to bail out the OMCs yet again. The Rs 22,000 crore cash support given explicitly for LPG under recoveries will need to increase and the government may need to work out a mechanism to compensate oil companies on their fuel under recoveries as well.

This may need to be done before the Q3 results of oil cos in January next year. In short, petroleum subsidies, either in the name of LPG losses or some other head , are back in the government’s fiscal math.

Indian Oil's EBITDA loss came at Rs 1,960 crore, up 44.2 percent from the previous quarter. The company's margin rose by 30 basis points to 0.9 percent from 0.6 percent.

On October 28, the shares of the oil major traded near their 52-week low of Rs 65.20. The shares of Indian Oil Corporation have fallen down nearly 10 percent this year and .

(Edited by : Asmita Pant)

First Published: Oct 29, 2022 5:54 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM