The big takeaway from the big four of the Indian IT pack - Tata Consultancy Services (TCS), Infosys, HCLTech and Wipro - is things are steady for now.

In fact, three out of the four companies - TCS, Infosys and HCLTech reported a revenue beat, while the only one that missed estimates on the topline, was Wipro.

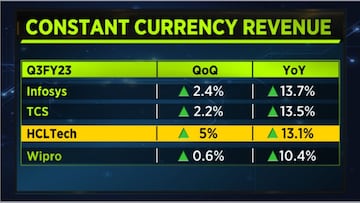

On a Quarter-on-Quarter (QoQ) basis, it's HCLTech, which tops the chart with the 5 percent revenue growth, on a constant currency basis, aided by strength in its seasonal products business. However, on a Year-on-Year basis, all four IT companies have reported a double-digit growth.

So, despite the macro uncertainty and fear of higher furloughs, execution for the big boys has been steady, and the topline growth has not been as bad as what the Street feared.

In terms of margin performance - it was a mixed bag. On one hand, Infosys and TCS both missed the mark. Their margins were lower than what the street anticipated. They were hit by a return to normalcy costs like travel.

On the other hand, HCLTech and Wipro, both of them reported a solid margin beat and an expansion. The INR depreciation, there was an improvement in utilization aided by fresher hiring, which boosted the margin performance.

Despite some slowdown in decision-making, deal wins this quarter have been fairly steady. It's not as bad as what the street was fearing. For Infosys, the large deal wins were at an eight-quarter high, TCS’ qualified deal pipeline is higher compared to the prior quarter, while Wipro’s overall deal wins in Q3 were at record levels.

On the whole, the pipeline has been fairly strong for the IT companies, though it's more biased towards cost optimization rather than traditional digital transformation deal, and many of these IT companies, the large ones, are benefiting from vendor consolidation.

Infosys is likely to top the growth this time with 16-16.5 percent. And if one compares it with the guidance that they had given at the beginning of the year, the growth rate is going to be a lot better.

For HCLTech, despite the little bit of a hiccup that the company had in December, the overall growth rate is going to be at the upper end of what they had guided. Therefore, this is going to be a good year and there are no issues that people have when it comes to the current financial year.

The problem is the next financial year has not been finalised. The tech budgets are not finalised. The commentary suggests that Europe is a bit challenging, decision-making has slowed down, although there is no deal cancellation. Wipro also spoke about slower ramp up in large deals and there are furloughs, which are hitting the IT companies in segments like BFSI, hi-tech.

On the supply side, attrition has moderated across the board. There is a decline on a sequential basis and hiring has been muted. For TCS and Wipro, the headcount has declined on a sequenial basis.

One of the reasons for the decline in the headcount is their attrition is coming down. So they need fewer people to fill up their workforce. However, the other reason, which the street fears, is that companies are preparing for a slowdown.

Now whether that plays out or not, one will have to see. But for now, the December quarter has been steady for the big boys and not as bad as what the street had feared initially.

For more, watch the accompanying video

First Published: Jan 17, 2023 10:15 AM IST