Aluminium and copper manufacturing company Hindalco reported its earnings for the April to June 2022 quarter, in which its net profit surged to a record high of Rs 4,119 crore, according to data released by the company.

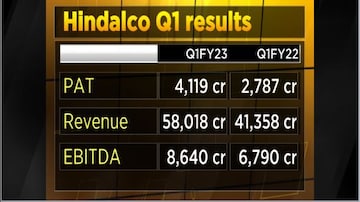

Hindalco's consolidated net profit for the quarter under review jumped 48 percent from Rs 2,787 crore in the corresponding quarter last year. Its consolidated revenue rose 40 percent on a year-on-year basis to Rs 58,018 crore against Rs 41,358 crore in the first quarter of the previous fiscal.

After the financial results were announced, Hindalco shares rose more than 5 percent intraday and were trading 4.39 percent higher at Rs 439.95 on BSE at 2:15 pm.

The company also posted an all-time high quarterly consolidated earnings before interest, taxes, depreciation, and amortisation (EBITDA) — a measure of operating profitability — at Rs 8,640 crore, up 27 percent YoY.

According to the company's statement, the excellent results were driven by better macros, robust performance of aluminium downstream and copper businesses along with better operating efficiencies.

Copper EBITDA stood at a record high of Rs 565 crore, up 116 percent YoY from Rs 261 crore in the same quarter last year. A CNBC-TV18 poll of analysts had projected the copper EBITDA to come in at Rs 333 crore. Copper rod sales, meanwhile, reached an all-time high during the three-month period to 80,000 tonnes, up 73 percent YoY.

Aluminium upstream EBITDA was recorded at Rs 3,272 crore, up 41 percent compared to the same quarter a year ago while EBITDA margin came in at 38 percent. The firm posted aluminium downstream EBITDA at Rs 158 crore, up 305 percent YoY while EBITDA per tonne at $261, up 306 percent YoY, according to the company's statement.

Commenting on the result, Satish Pai, Managing Director, Hindalco Industries, said the company’s earnings for the June 2022 ended quarter were even stronger than the previous quarter, despite rising input costs and inflationary pressures.

“Our performance was backed by strong operational efficiencies and pre-emptive sourcing of critical raw material, thus ensuring stable operations and higher margins. Our business model supports our position as an integrated aluminium producer with one of the world’s best EBITDA margins,” he said in a statement.

Our product mix enhancement strategy is working well with the Aluminium Downstream EBITDA growing four-fold YoY. Novelis reported its highest ever EBITDA per ton driven by higher product pricing, favourable product mix and higher recycling benefits. Looking ahead, we remain focused on riding all market cycles with our greener, stronger, smarter approach.”

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election Phase One: Bengal records 34% voting, Maharashtra 19%, Jammu 23% till 11 am

Apr 19, 2024 12:56 PM

Two TMC activists injured in attack in Bengal's Cooch Behar hours before polling

Apr 19, 2024 12:09 PM

Lok Sabha Polls 2024: Here is how the markets fared in Modi government's second term

Apr 19, 2024 11:44 AM

Lok Sabha elections 2024: Dibrugarh braces for intense electoral battle

Apr 19, 2024 11:18 AM