Pharmaceutical company Aurobindo Pharma will report its financial results for the April to June 2022 period on Thursday.

Though a low base may offer support and its revenue may rise, the company’s profit, margin and earnings before interest, taxes, depreciation, and amortisation (EBITDA) are likely to decline compared to the first quarter of the last fiscal, according to a CNBC-TV18 poll of analysts. However, the earnings are likely to improve on a sequential basis.

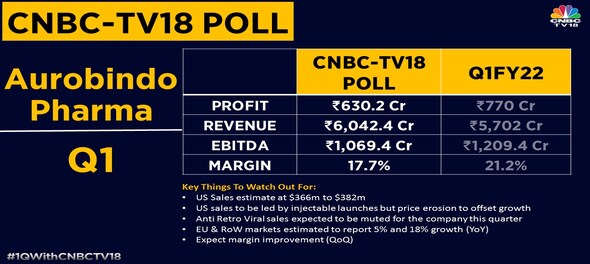

The Street expects the drug manufacturer’s revenue for the three-month period to rise 6 percent year-on-year (YoY) to Rs 6,042.4 crore compared to Rs 5,702 crore in the same quarter last year. Compared to the previous quarter when revenue was recorded at Rs 5,809, this quarter’s figure maybe 4 percent higher.

Aurobindo Pharma's profit for the quarter under review is likely to fall 18 percent YoY to Rs 630 crore from Rs 770 crore the corresponding quarter last fiscal. This, however, means a 9 percent jump from Rs 577 crore profit in the preceding quarter, the poll suggests.

According to the poll, US sales are estimated at $366 million to $382 million versus $364 million last quarter. Sales shall be led by injectable launches but price erosion is likely to offset growth, it said. The European Union (EU) market is estimated to report 5 percent growth and about 18 percent YoY in the rest of the world’s countries.

Aurobindo Pharma’s margin is likely to decline YoY but may improve on a quarter-on-quarter basis. Analysts polled by CNBC-TV18 say the margin for the quarter will decline to 17.7 percent from 21.2 percent in the same quarter last year but up from 16.8 percent in the previous quarter.

US price pressure in addition to higher input costs and muted anti-retrovirals (ARV) sales are likely to impact YoY margin, the poll suggests. ARV business is seen tapered with COVID-19 ebbing, it added.

EBITDA for June 2022 ended quarter is likely to come in at Rs 1,069 crore, down from Rs 1,209 crore in FY22’s first quarter, according to the poll.

The Street will also keenly watch the pharmaceutical firm’s research and development (R&D) spend, which was at a record 7.5 percent of sales in the fourth quarter of FY22. Analysts will also be on the lookout for the management's comments on US FDA concerns and speciality business estimate of $650-700 million in FY24 versus a base of $438 million.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

LS polls phase 2: Rahul Gandhi, Shashi Tharoor in fray; Hema Malini, Om Birla eyeing hat-trick

Apr 25, 2024 12:19 PM

UP constituencies to witness three-cornered fight in second phase tomorrow

Apr 25, 2024 10:47 AM

BJP MP's wife challenges him in electoral battle for Etawah seat

Apr 25, 2024 9:39 AM