Around 80 percent of global investors are likely to have lost money on their cryptocurrency investments, says a study, as the market reels under pressure amid the collapse of a major crypto exchange.

A recent study conducted by the Bank for International Settlements (BIS) in collaboration with IntoTheBlock and CryptoCompare, revealed that more than 73 percent of users who downloaded crypto apps did that while the Bitcoin prices were hovering above $20,000 – above the price of Bitcoin in October 2022.

If these users invested in Bitcoin on the same day they downloaded a crypto exchange app, they would have incurred a loss on this initial investment, it said.

This led to an average estimate of investors experiencing unrealised losses in the long term. Bitcoin prices took a steep plunge after the FTX meltdown, reaching support at $16,000.

Analysis of blockchain data finds that, as prices were rising and smaller users were buying Bitcoin, the largest holders (also called “whales” or “humpbacks”) were selling — making a return at the smaller users’ expense.

The study also highlighted the trends of Bitcoin prices and the factors driving its adoption across diverse age groups and demographics across 95 countries around the world over the span of seven years, from 2015-2022.

“Overall, back-of-the-envelope calculations suggest that around three-quarters of users have lost money on their bitcoin investments,” the study said.

During the period under review, the price of bitcoin rose to peak at nearly $69,000 in November 2021 from $250 in August 2015.

Moreover, the number of people using smartphone apps to purchase and sell cryptocurrencies increased to 32.5 million from 119,000 during the same period.

Also Read: Explained: The IMPT token and why traders believe it is one of the best upcoming investments

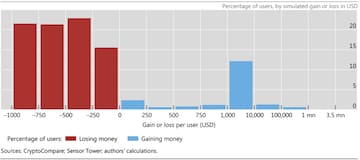

The study assumes that each new user bought $100 of Bitcoin in the month of the first app download and in each subsequent month, 81 percent of users would have lost money, as shown in the above graph. The median investor would have lost $431, corresponding to 48 percent of their total $900 in funds invested.

Most of the wallets are projecting increasing losses

Recent studies from Glassnode, another prominent Blockchain analytics firm, showed that one-third of the total supply of Bitcoins held by investors was running into losses.

The Glassnode report showed that as of November 9, 2022, 35.4 percent of the total supply of Bitcoin was held by long-term holders (LTHs), amounting to more than 5.9 million BTC. All these LTHs were holding their BTC at a loss.

On the other hand, the short-term holders (STHs) accounted for another 17 percent of the total BTC supply and were holding their assets at a loss. Only a mere 0.06 percent of the STHs were in profit.

This shows how most Bitcoin investors have been sitting on unrealised losses over the years. Most of these are long-term holders who have not seen any profits as Bitcoin prices do not show potent signs of recovery to former levels.

Meanwhile, the latest study conducted by CoinDesk in collaboration with IntoTheBlock, shows more than 51 percent of the total 47.9 million Bitcoin wallet addresses were holding their coins at a value that is under the value at which they purchased their coins, thereby sitting on losses. Whereas the other 45 percent of investors were sitting on unrealised gains.

In Conclusion

It is a fact that previously, we have seen the bear markets end with most wallets spilling red on their ledger. During previous bear markets in 2015 and 2019, the percentage of wallets running on losses was 62 percent and 55 percent, respectively.

Although one can check past data to predict future outcomes, in the case of cryptocurrencies, market volatility makes it difficult to do so. Many factors, such as utility, project relevance, geopolitical issues, and others, affect the crypto space profoundly. Moreover, the FTX meltdown will have obvious repercussions on the regulatory space. As a result, making confident BTC predictions is challenging now.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Odisha Lok Sabha elections: Schedule, total seats, Congress candidates and more

Apr 20, 2024 11:39 AM

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM