You don’t need to be an industry insider, or even a dedicated fan, to know that the way we consume music has seen a world of change in the last few decades. In less than four decades, formats like the audio CD, digital downloads, internet radio and streaming services have each ‘killed’ the music industry, only for it to be resurrected by the next big thing.

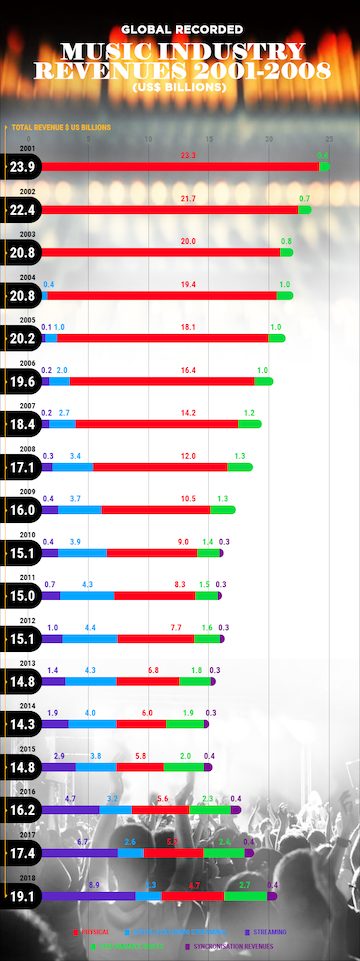

While growing connectivity and new-age platforms have increased access and exposure to music, their meteoric rise has led to a steady decline in music sales, which plummeted from $23.9 billion in 2001 to $14.3 billion in 2014. However, there has since been a gradual increase in revenues from recorded music across the globe, and last year was no exception. The Global Music Report 2019, put together by the International Federation of the Phonographic Industry (IFPI), dissected the factors behind this, and highlighted other relevant trends on the landscape.

The Resurrection of Recorded Music

Ever since the advent of peer-to-peer file sharing, it seems as if every headline about record sales has spelled doom and gloom. The 21st century has seen revenues from recorded music shrinking with every passing year until things took an upturn in 2015. In fact, 2018 was only the fourth consecutive year of global growth at 9.7 percent, the highest since the IFPI started tracking the market in 1997.

This was largely driven by digital media, revenues from which crossed over $10 billion for the first time ever last year. Paid subscriptions to streaming services played a crucial role in the industry’s overall upswing, making a 37 percent contribution to total revenues. However, this doesn’t mean that all hope is lost for physical formats. Though revenues dropped by 10.1 percent, physical music has seen a resurgence in many parts of the world, including India, where sales grew by a whopping 21.2 percent. This trend, which was also observed in Japan and South Korea, can partly be attributed to the resurgence of vinyl, which the Recording Industry Association of America (RIAA) has dubbed “a bright spot among physical formats”. In fact, physical music garnered revenue of $1.5 billion in the USA in 2017, surpassing digital downloads, which only brought in $1.3 billion.

A Shifting World Order

One of the biggest concerns that came with an increasingly globalised streaming world was the possible global proliferation of Anglo musicians and subsequent loss of local musical traditions. “While international opportunities for Anglo artists have increased, we’re also seeing a huge flow of music back the other way,” said Jeremy Marsh, Chief Global Marketing Officer, Warner Music Group. “We’ve seen this with music from markets such as Latin America and Korea, and we’re starting to see it with music from regions like Africa too.”

The proof lies in the numbers. South Korean boy band BTS’ meteoric rise propelled them to becoming the second-highest-selling recording artists of the year, capturing the second and third spots on the top 10 albums chart. However, BTS isn’t an anomaly – Cuban-American singer Camila Cabello had the top digital single of 2018, closely trailed by Puerto Rican singer Luis Fonsi and Chinese songstress Tia Ray.

This is hardly surprising, given that Latin America and Asia and Australasia recorded the largest global growth, at 16.8 percent and 11.7 percent, respectively. However, it’s not just consumers in these markets driving the demand for more global music. Korean pop music was streamed more than 100 million times in Peru, Canada, France and Turkey on Spotify last year, cementing the business case for diversity.

The India Insight

Warner Music Group’s Alfonso Perez-Soto noted, “The younger demographic in territories like Africa, India, the Middle East and Eastern Europe are all embracing technology and getting more connected every day. That’s something that will completely change the scope of our industry.”

It wouldn’t be too far-fetched to say that emerging markets are already shaking things up. Market leader Spotify entered India with a far more cost-effective subscription plan than rival Apple Music, which has been in the market for nearly four years now. Mere weeks after the launch of Spotify and YouTube Music, though, Apple Music slashed its monthly subscription price to as low as Rs. 99, in a noteworthy development.

Combine this competitive market with localised offerings and the world’s cheapest data prices, and the Indian market’s potential has never been more apparent. However, the Music Streaming Apps Survey Report 2019 by CyberMedia Research found that an overwhelming number of Indian respondents prefer free platforms or tiers to their paid counterparts, which does bring into question the country’s impact on global music revenue.

And while that remains to be seen, two things are clear: Is the music industry, as we once knew it, dead? Probably. Are there even greater things on the horizon? Almost definitely.

First Published: Apr 6, 2019 7:43 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Gurugram gears up for crucial polls amidst economic boom and civic woes

Apr 24, 2024 11:41 PM

Lok Sabha Election 2024: Crucial seats up for grabs as Rajasthan, Maharashtra, Bihar gear up for 2nd phase of polls

Apr 24, 2024 11:40 PM