The Insurance Regulatory and Development Authority (IRDAI) has not just set growth targets for life insurance companies, but it has made sure the general insurance industry is not out of this net as well.

If one thought that the premium growth targets for life insurance companies were steep, then with the general insurance companies these targets only get more aggressive.

IRDAI intends to take the general insurance penetration in India to 2.5 percent by the 2026-27 fiscal from the present 1 percent. The insurance penetration is the ratio of premium top GDP and here the insurance regulator wants to take the premium collected by general insurance industry from Rs 2.2 lakh crore all the way up to Rs 11.7 lakh crore.

Just like for life insurance companies, these growth targets for general insurers have been set based on their past performance, their distribution network and their current premium base.

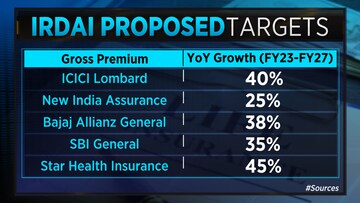

Targets for some of the large and listed general insurance companies

For ICICI Lombard, the IRDAI has proposed a target of 40 percent premium growth. It is expected to grow year-on-year till FY27. For New India Assurance, the IRDAI has proposed a premium growth target of 25 percent. For Bajaj Allianz General Insurance, the proposed target stands at 38 percent and for SBI General and Star Health Insurance it is 35 percent and 45 percent, respectively.

How does the historical growth rate compare to the IRDAI target

No doubt, the targets for general insurance companies are tall, but here is how the historical growth rate compare to the IRDAI target for these companies for example — ICICI Lombard and New India Assurance.

For ICICI Lombard, the strongest growth of 30 percent came in FY22, which was also because of a strong base effect. The target for ICICI Lombard is still away at 40 percent.

For New India Assurance, the best growth came in FY20 and FY22 of around 12 percent. Looking at the IRDAI target, the New India Assurance would have to more than double its premium to achieve these targets.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Exclusive: FM Nirmala Sitharaman says poverty alleviation can't be achieved by throwing money at the problem

Apr 18, 2024 7:27 PM

Tamil Nadu Lok Sabha elections 2024: List of Congress candidates

Apr 18, 2024 4:33 PM

Will the payment under PM-KISAN be increased? Here's what Finance Minister said

Apr 18, 2024 3:58 PM