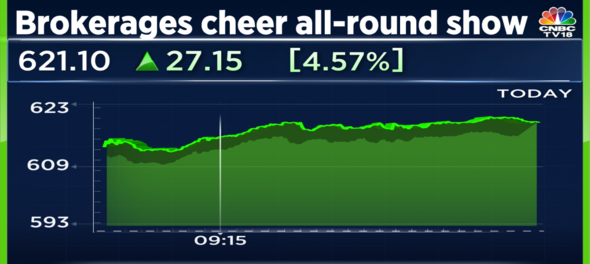

Analysts across the board have raised price targets on India's largest lender State Bank of India Ltd. after its strong earnings performance during the September quarter.

The lender reported its highest ever quarterly profit led by a 20 percent year-on-year loan growth, which was the highest in 19 quarters. The bank's asset quality also improved with Gross NPA being the best in seven years, while net NPA declined below the 1 percent mark for the first time in 7-8 years.

Analysts who track SBI termed the quarter as a strong show on all counts with more still to come from the lender. Most of them have raised price targets on the stock. Earnings estimates have also been revised higher by 6-17 percent for the current financial year.

| Brokerage | Rating | Old Price Target (Rs.) | New Price Target (Rs.) |

| Morgan Stanley | Overweight | 675 | 715 |

| Nomura | Buy | 615 | 690 |

| JPMorgan | Overweight | 650 | 720 |

| Jefferies | Buy | 700 | 760 |

| Goldman Sachs | Buy | 728 | 770 |

| Nuvama | Upgrade to Buy from Hold | 595 | 715 |

| ICICI Securities | Buy | 673 | 805 |

| Credit Suisse | Outperform | 680 | 680 |

Morgan Stanley expects SBI's net interest margin to improve further and credit costs to be lower. Both of these will offset higher costs related to wage hikes, according to the broking firm.

Credit Suisse believes that more is yet to come from India's largest lender. It raised its Earnings per Share (EPS) estimates for SBI for the current and the next two financial years by 6 percent and 1 percent each respectively. At 1.2x price-to-book value for the upcoming financial year, it termed SBI's valuations as inexpensive.

SBI is likely to deliver Return on Equity (RoE) of 15 percent between the current and financial year 2025, according to Nomura. For the similar timeframe, the brokerage sees the bank's Return on Assets (RoA) to hover around the 0.9 percent mark. SBI's RoA crossed 1 percent for the first time ever in the September quarter.

Along with raising its price target on SBI, JPMorgan has also revised its EPS estimates higher by 11 percent and 5 percent respectively for the current and the upcoming financial year. The brokerage expects the bank's RoA, which crossed 1 percent in the September quarter to sustain as it moves into a seasonally strong second half of the year.

Goldman Sachs has termed SBI's earnings quality to be one of the best during this earnings season which is reflected by its healthy growth in deposits, strong asset quality and broad-based loan growth. The brokerage also revised its net profit estimates for the current and financial year 2024 higher by up to 14 percent and 2.5 percent respectively.

First Published: Nov 7, 2022 7:59 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Gurugram gears up for crucial polls amidst economic boom and civic woes

Apr 24, 2024 11:41 PM

Lok Sabha Election 2024: Crucial seats up for grabs as Rajasthan, Maharashtra, Bihar gear up for 2nd phase of polls

Apr 24, 2024 11:40 PM