Saurabh Mukherjea remains bullish on the Indian IT space, something he describes as a "must have for a high quality India portfolio", and continues to hold Tata Consultancy Services (TCS). The remarks from the veteran fund manager and founder of Marcellus Investment Managers come at a time when IT remains one of the biggest underperformers on Dalal Street, with the country's software exporters struggling against high attrition — and subsequent employee costs — eating into their margins.

“TCS remains one of our largest holdings there... We don't really have any compunctions,” said Mukherjea.

"Whoever is building a sensible high quality Indian portfolio, you have to have Indian IT in it. It's one of those rare sectors where we have world class companies, which are in the top two or top three in the world,” he added.

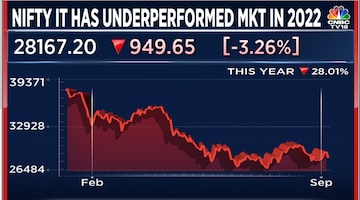

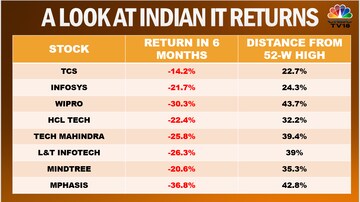

The Nifty IT — whose 10 constituents include TCS, Infosys, Wipro, HCL Tech and Tech Mahindra — remains deep in the bear zone, even as the benchmark Nifty50 has come within three percent of its lifetime high, clocked in October 2021.

A stock or index is said to be in bear territory when it retreats at least 20 percent from its recent peak. As of Tuesday's closing level, the IT gauge was more than 26 percent below its peak.

Why Saurabh Mukherjea prefers TCS to midcap IT

Mukherjea said he struggles to understand the business case for mid-tier IT companies.

"These tend to be vertical specific and you and I are left second guessing which vertical will thrive at what time. A firm like TCS covers the waterfront. But most importantly, a firm like TCS has very strong supply-side advantages, which mid-tier IT firms don't and this is an important point," he explained.

"Mid-tier IT firms don't have supply side advantages on the recruitment training side and hence we steer clear of them," said Mukherjea, author of Coffee Can Investing and Unusual Billionaires.

Brokerages have mixed views on the Indian IT space. Nomura and Goldman Sachs have a cautious stance, but Macquarie believes the fears are overdone.

Mukherjea is positive on India's economic growth.

“Our view remains as it has for several years like this country's economy is in reasonably good shape. We are formalising the country. As we formalise the country, the black economy is getting crunched and well run companies benefiting from that," he said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

(Edited by : Akanksha Upadhyay)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM