Broking firm CLSA has initiated coverage on PB Fintech, the owner of online insurance and credit comparison portals Policybazaar and Paisabazaar with a buy recommendation.

CLSA's price target of Rs 600 implies a potential upside of nearly 55 percent from Tuesday's closing levels.

However, the stock will still remain 40 percent below its IPO price of Rs 980, even if it manages to achieve CLSA's projected price target.

The brokerage sees PB Fintech as a key beneficiary of the growing share of online insurance distribution. The firm expects the broader insurance industry to grow at an above-average compounded annual growth rate (CAGR) of 10 percent over the next 15 years.

Through Policybazaar, PB Fintech handles over 90 percent of the online insurance sales by third parties.

CLSA expects PB Fintech to deliver a 38 percent compounded growth rate in premiums until financial year 2026. For the same period, it also expects contribution margin to expand to 32 percent from the current 24 percent. The growth in premiums is also likely to aid a 37 percent compounded revenue growth until financial year 2026.

The brokerage is expecting the currently loss-making PB Fintech to break even by the second half of financial year 2024 and to have a Profit Before Tax (PBT) worth Rs 600 crore by financial year 2026.

Despite some bullish commentary from CLSA, some long-term challenges still remain with the company. The company has requested Insurance Regulatory and Development Authority (IRDAI) to allow them to reduce commission rates, while seeking allowance on matching lower commissions as Bima Sugam, sources informed CNBC-TV18.

IRDAI had proposed the formation of Bima Sugam, an aggregator-like platform for insurance sales and related services. Industry feedback suggests that this platform is likely to charge commissions at a much lower rate than current levels.

Insurance aggregators could face the heat with the entry of Bima Sugam, which will be responsible for sales, servicing, and claims of insurance policies, possibly everything that Policybazaar does.

Even CLSA has highlighted exclusion from the IRDAI-proposed insurance exchange platform as a key risk to their estimates on PB Fintech. Competition from superapps has been highlighted as another risk.

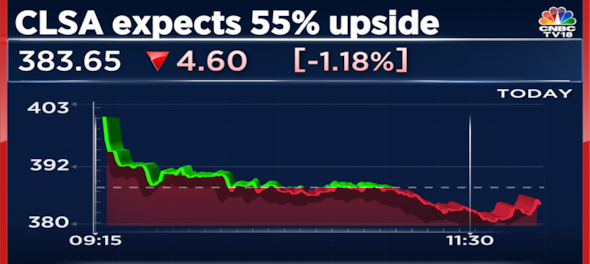

Shares of PB Fintech opened higher but gave up all the gains to currently trade 1.7 percent lower at Rs 381.80.

First Published: Nov 16, 2022 12:04 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM

West Bengal Lok Sabha elections: Abhishek Banerjee to Mahua Moitra, a look at TMC's candidates

Apr 19, 2024 6:14 PM

Chhattisgarh Lok Sabha elections 2024: Bhupesh Baghel among the list of Congress candidates

Apr 19, 2024 3:45 PM

Chhattisgarh Lok Sabha elections 2024: Full list of BJP candidates

Apr 19, 2024 1:46 PM