PayTM’s Vijay Shekhar Sharma on Friday said that the company's operating profitability was achieved three quarters ahead of the guidance. One97 Communications Limited (OCL) that owns the brand Paytm, has achieved its operating profitability milestone with EBITDA before ESOP cost at Rs 31 Crore, significantly ahead of its guided timeline of September 2023.

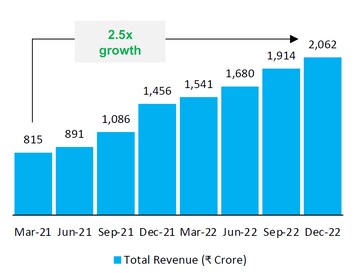

Strong revenue from its operations, especially the loan business, helped it achieve Rs 2,062 crore in December 2022 quarter, registering a growth of 42% against the same period of the preceding year and 8% against the previous quarter ending September 2022.

PayTM in a statement said this was largely driven by adoption by consumers and subscription services by merchant partners along with sustained growth seen in loan distribution and commerce business. Revenue from financial services or loan disbursements now accounts for 22% of the total revenues, and has gone up 9% in the December quarter.

Contribution profit was ₹1,048 Cr in the quarter, with margins consistently improving from 31% in Dec-21 to 51% in Dec-22 on account of improved profitability of payments business and increased mix of high margin businesses such as loan distribution. Net payment margin grew to ₹459 crore (up 120% YoY) on the back of improved profitability in the payments business.

The company’s loan distribution business saw further scale with 10.5 million loans amounting to ₹9,958 Cr disbursed in the quarter (in partnership with its lending partners). Total number of unique borrowers who have taken a loan through the Paytm platform has increased by 1.4mn in the quarter to 8.1 mn as of December 2022.

The company said that it will maintain discipline on costs, as it continues to invest in areas where it sees potential for future growth, such as marketing (for user acquisition) or sales team (to increase merchant base and subscription services). The company will continue to focus on building a sustainable and long-term cash generating business.

Also read:

(Edited by : Pradeep John)

First Published: Feb 3, 2023 10:18 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM