Oil and Natural Gas Corporation (ONGC) shares were in high demand on Friday as investors waited for the state-run oil and gas explorer to report its quarterly earnings later in the day. Investors will look out for any improvement in oil realisation and the management's commentary on windfall taxes.

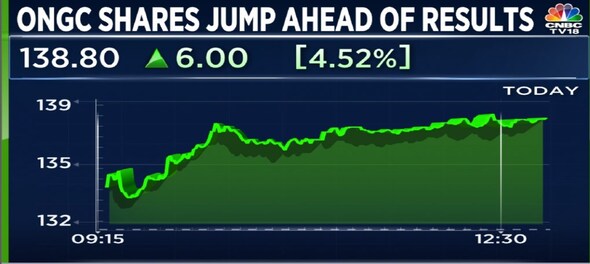

ONGC shares jumped as much as 4.9 percent to Rs 139.2 apiece on BSE.

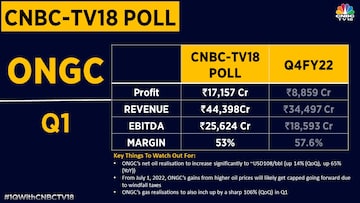

Analysts in a CNBC-TV18 poll expect the state-run explorer to report a nearly two-fold jump in net profit to Rs 17,157 crore for the April-June period. ONGC's net profit had stood at Rs 8,859 crore for the corresponding period a year ago.

They estimate the company to clock revenue growth of 28.7 percent on a year-on-year basis to Rs 44,398 crore for the three-month period.

However, ONGC is likely to take a hit of 460 basis points in its margin to 53 percent compared with the year-ago period, according to the CNBC-TV18 poll.

Analysts will closely look out for the management's commentary on the possible impact of the government's move to tax the windfall out of the surge in crude oil prices in recent months.

From July 1, the earnings of downstream oil companies such as ONGC will be limited on account of the new tax.

This month, the government cut the windfall tax on diesel and aviation turbine fuel (ATF) but raised the duty on domestically produced crude oil. It revised the tax on crude oil from Rs 17,000 per tonne to Rs 17,750 per tonne, and the export duty on diesel from Rs 11 per litre to Rs 5 per litre and removed it on jet fuel and petrol.

In July, it imposed a tax of Rs 6 per litre on the export of petrol and aviation turbine fuel (ATF) and Rs 13 per litre on exporting diesel and announced an additional tax of Rs 23,250 per tonne on crude oil produced domestically.

The recent changes are widely expected to impact refiners such as ONGC.

The Street estimates ONGC's realisations to improve significantly in the quarter-ended period.

The analysts polled by CNBC-TV18 peg the company's net oil realisation — or the actual money earned from oil sales — to come in at $108 a barrel, up 65 percent compared with the year-ago period.

ONGC shares have rewarded investors with a return of 11.8 percent in the past one month, outperforming the Nifty50 benchmark's 10 percent rise.

(Edited by : Sandeep Singh)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM