Oil stocks saw mixed moves on Thursday as benchmark crude rates hovered close to their lowest levels recorded in seven months. Shares in oil explorers ONGC and Oil India declined almost one percent at the weakest level of the day, and those in oil marketers Indian Oil, Bharat Petroleum and Hindustan Petroleum gained as much as 1-4 percent.

Crude oil prices bounced back by about $1 a barrel on Thursday, a day after hitting sliding below key technical levels amid an energy standoff between Europe and Russia.

Brent futures — a global benchmark for crude oil — rose as much as 0.7 percent to $88.6 a barrel. On Wednesday, the contract had settled at its lowest lowest since early February.

West Texas Intermediate (WTI) futures gained 0.9 percent to $82.6 a barrel.

Earlier this month, India raised the windfall tax on domestically produced crude oil from Rs 13,000 per tonne to Rs 13,300 per tonne. It also increased taxes on aviation turbine fuel — or jet fuel — exports to Rs 9 per litre from Rs 2 per litre.

Cooling off crude oil rates dent the profitability of refiners such as ONGC, but boost the margins of oil marketing companies such as Indian Oil.

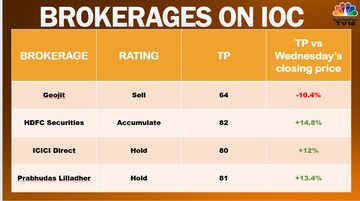

Analysts have mixed views on oil & gas stocks, with some suggesting up to 34 percent upside in ONGC.

"One should avoid the entire oil & gas pack, which is always subject to volatility in international prices and local taxes... These stocks have created lots of noise in the past years but no real wealth as such," AK Prabhakar, Head of Research at IDBI Capital Markets, told CNBCTV18.com.

"Even those holding ONGC shares can just exit on any chance they get," he said.

India meets the lion's share of its oil requirement through imports.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Gurugram gears up for crucial polls amidst economic boom and civic woes

Apr 24, 2024 11:41 PM

Lok Sabha Election 2024: Crucial seats up for grabs as Rajasthan, Maharashtra, Bihar gear up for 2nd phase of polls

Apr 24, 2024 11:40 PM