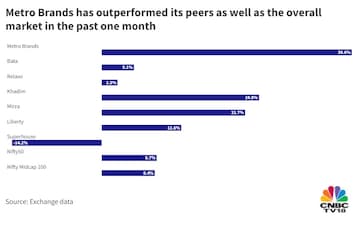

A Mumbai-based footwear retailer's shares have given a return of almost 40 percent in just one month. That, even after the stock has given up almost seven percent of its value in the past four days.

Despite the recent correction, analysts are positive on the company's strong fundamentals and store addition.

The stock of Mumbai-based Metro Brands — whose brands include Metro, Mochi, Walkway, Crocs and Cheemo — commands a premium of 61.6 percent over the upper end of its IPO price range.

Metro Brands began its journey in the secondary market in December 2021 following a lukewarm response to its IPO.

As of June 30, Metro Brands operated 644 stores across 147 cities spread across 30 states and Union Territories in the country.

What's lifting the stock?

According to HDFC Securities, Metro has the right mix with three umbrella brands and two exclusive brand outlet tie-ups providing a growth opportunity going forward. The brokerage is positive on the company's ramping up of capabilities and its efficiency on cost optimisation and profit generation.

"Metro’s asset light business model with an efficient business model, potential of growth in third party brands, strong fundamentals with robust revenue and profitability growth, zero debt status and strong promoter and experienced management team brings positive view on the stock," said HDFC Securities, which has a 'buy' call on the stock.

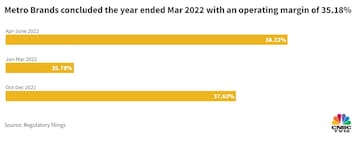

Last month, Metro Brands reported a net profit of Rs 103.2 crore for the April-June period on the back of strong business momentum, as against a net loss of Rs 10.3 crore for the corresponding period a year ago. The company said it was its best quarterly performance ever, reflecting its reflecting the robustness of its operational model and the efforts of its team.

For the January-March period, the company had posted a net profit of Rs 67.5 crore.

Its revenue grew nearly four times to Rs 497.2 crore for the quarter ended June 2022, from Rs 126.2 crore for the year-ago period, according to a regulatory filing.

The company's management said its business continued the momentum that it attained in the three months to December 2021.

The stock has already surpassed HDFC Securities' bull case fair value for the stock at Rs 683, which is at 55.5 times its earnings per share estimate for the year ending March 2024.

At Friday's closing price of Rs 807.9, Metro Brands shares are within seven percent of an all-time high clocked this week.

First Published: Aug 22, 2022 8:23 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

LS polls phase 2: Rahul Gandhi, Shashi Tharoor in fray; Hema Malini, Om Birla eyeing hat-trick

Apr 25, 2024 12:19 PM

UP constituencies to witness three-cornered fight in second phase tomorrow

Apr 25, 2024 10:47 AM

BJP MP's wife challenges him in electoral battle for Etawah seat

Apr 25, 2024 9:39 AM