A strong order backlog and a softer commodity environment is likely to aid Larsen & Toubro's September quarter earnings performance.

The Engineering & Infrastructure conglomerate will report results on Monday, October 31.

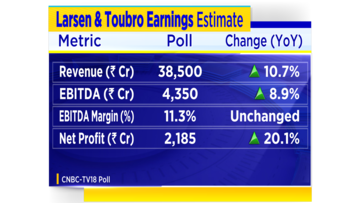

According to a CNBC-TV18 poll, the company's net profit may grow in excess of 20 percent from last year while revenue and operating profit may grow in double-digits and high-single-digit respectively. Margin is likely to remain flat.

The company disclosed orders worth nearly Rs 14,200 crore during the July-September period led by orders in the water, transmission, hydrocarbon, buildings, and factories business.

Here are some of the orders disclosed by L&T during the quarter:

| Date | Business | Order | Size (` Cr) |

| 11-Jul | Buildings & Factories | Significant | 1,000 - 2,500 |

| 10-Aug | Heavy Civil Infra | Significant | 1,000 - 2,500 |

| 22-Aug | Hydrocarbon | Large | 2,500 - 5,000 |

| 15-Sep | Water & Effluent Treatment | Significant | 1,000 - 2,500 |

| 28-Sep | Buildings & Factories | Significant | 1,000 - 2,500 |

JPMorgan expects a strong quarter for the company led by the Engineering and Construction business. The brokerage expects a decline in steel prices to benefit fixed price contracts, which form 33 percent of the total orders.

L&T's order book at the end of the June quarter stood at Rs 3.63 lakh crore with international orders making up 28 percent of the total.

Domestic steel prices have averaged Rs 63,000 per tonne in the first half of the current financial year compared to Rs 66,000 per tonne in financial year 2022.

BofA Securities says that the valuation of L&T's subsidiaries has deteriorated by 37 percent this year while the implied core multiple has expanded by 43 percent. The brokerage has cited a turnaround in the Hyderabad Metro project as a key medium-term trigger.

Among key factors to watch for the company include management commentary on various segments and order prospects for the second half of the current financial year. Trends within the core Engineering & Construction business along with working capital and cash flow management will be some of the other key things to watch out for.

Shares of Larsen & Toubro have not done much this year and are trading with gains of close to 3 percent.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM