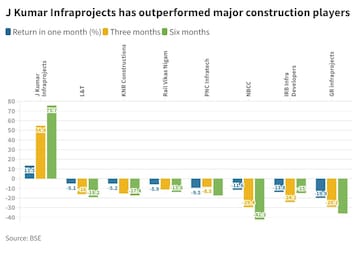

Most construction companies are under margin pressure owing to higher input costs but J Kumar Infraprojects has rewarded investors with a return of approximately 55 percent in just three months. This comes at a time when central banks have lined up aggressive hikes in COVID-era interest rates to tame red-hot inflation amid fears of a slowdown in the markets.

Mumbai-based construction company J Kumar Infraprojects' shares have grown almost 76 percent in value in six months — a period in which the Nifty50 has corrected almost 11 percent.

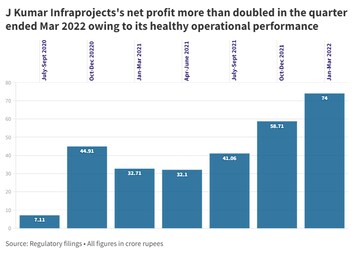

Most analysts have positive views on the stock citing the construction company's strong financials as well as the order book amid higher input costs leading to margin pressure.

Deepak Jasani, head of retail research at HDFC Securities, likes J Kumar Infraprojects for its strong order book, healthy bidding pipeline, and efficient and timely execution.

"Disciplined and selective bidding for projects has helped the company maintain a decent margin consistently. It is uniquely placed among infra companies due to its expertise in underground metro works with its own equipment," he told CNBCTV18.com.

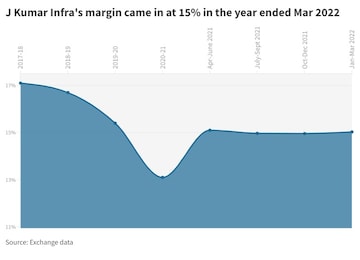

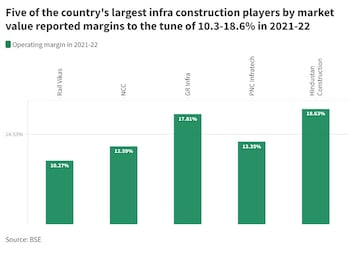

J Kumar Infra's margin in the year ended March 2022 was better than most of its larger peers.

A bumpy road ahead?

Road contractors are set for a decline of 200-250 basis points in operating profitability — or the amount of money a road developer earns as a percentage of its sales — to a decadal low in the year ending March 2023, citing aggressive bidding and high input costs, according to CRISIL.

"Construction contracts have escalation clauses which help contractors pass on key raw material price variations for contracts under execution. In an inflationary environment, such escalations help in protecting profitability margins of contractors," Mohit Makhija, Senior Director at CRISIL, told CNBCTV18.com.

Contractors often face volatility in profitability depending on the nature of the work due to the lag effect caused by such escalations, he said.

CRISIL expects the prices of steel, bitumen and cement — the key raw materials for the segment — to remain at elevated levels during the year, following a rise of 26 percent, 60 percent, and 4 percent in the year ended March 2022.

Should you buy the stock now?

HDFC Securities analysts expect J Kumar Infraprojects to clock an EBITDA margin of 14-15 percent in the year ending March 2023, with an order book that provides revenue visibility for the next 2-3 years.

As of March 2022, J Kumar Infra's order book stood at Rs 11,936 crore, indicating the visibility of 3.4 times its revenue in the year ended March 2022, said Jasani, who suggests buying the stock at current levels for a "decent upside".

The stock is trading at a discount to its peers due to its high exposure to metros, he pointed out.

Technical outlook

Hemen Kapadia of KRChoksey believes the construction stock is in a long-term uptrend with a positive outlook. "However, an overbought situation on the daily chart suggests the probable onset of a correction... A three-day close above Rs 305 would negate this view," Kapadia told CNBCTV18.com.

"A close below the Rs 280 level will hint at the onset of a corrective phase that could take it down to Rs 265 or even Rs 250," he said.

Kapadia prefers to wait for lower levels to take a positive view on the stock given the quantum and speed of its recent run.

First Published: Jul 7, 2022 8:40 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM