IndiaMART InterMESH — an online B2B marketplace — is confident of finishing the financial year with revenue growth to the tune of 20 percent and above, banking on a recovery in enquiries and customer addition. "April, May and June were specifically bad during the (Russia-Ukraine) war and the inflationary problems, but now I think that is behind us to some extent," Dinesh Agarwal, Founder and CEO of IndiaMART InterMESH, told CNBC-TV18.

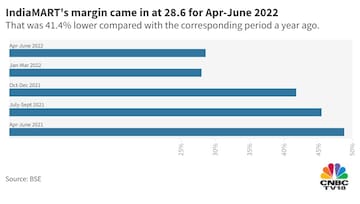

Remarks from the chief of IndiaMART InterMESH, which operates through web-related services and accounting software services segments, comes at a time when business across sectors are hoping to see a pickup in margins. This comes amid easing input costs after months of elevated levels of raw material prices.

IndiaMART has been gaining market share in the e-commerce space, and is confident of adding 8,000-9,000 suppliers to its paying subscriber base every quarter for the next few quarters, said Agarwal.

"We have been adding about 8,000-9,000 customers per quarter now as against 5,000-6,000 that we used to add pre-COVID. Given the economy has now opened up completely from COVID, I think our sales and service forces are completely on the ground," he said.

The management believes its daily business enquiries, which used to be in the range of 24-25 million earlier, should return to 23-24 million going forward.

It is confident of meeting its revenue guidance of 20 percent for the year ending March 2023 given strong collections from operations on the back of a a low base and a rise in its supplier base. "We will continue to maintain 20-plus percent revenue growth," Agarwal added.

With cash of Rs 2,000 crore on its books, IndiaMART will continue to look for investment and M&A opportunities. "We are trying to properly integrate Busy Infotech into the our systems and operations," he said. IndiaMART completed the acquisition of a 100 percent stake in accounting platform Busy Infotech for Rs 500 crore in the beginning of the April-June period.

IndiaMART shares have lagged the overall market with a return of 5.4 percent in the past three months, a period in which the

Nifty50 benchmark has risen 9.1 percent.