Hindustan Unilever said that it managed to maintain its operating margin despite "unprecedented inflation" in input costs. The management said that overall commodity inflation is significantly elevated as prices of sugar and cereals remain on the higher side.

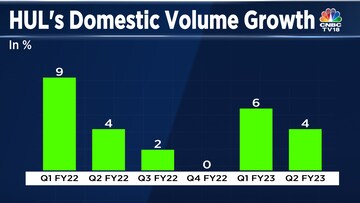

The FMCG major reported volume growth of 4 percent during the September quarter, in-line with a CNBC-TV18 poll that had pegged the volume growth to be between 4-5 percent.

While the management said that volume growth for the company was positive, the industry is still going through a period of negative volume growth.

However, the management is "cautiously optimistic" as September turned out to be a very good month for the company.

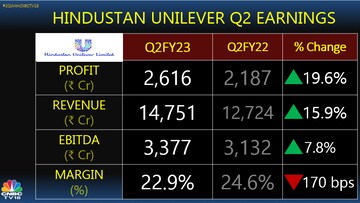

The company's revenue of Rs 14,751 crore was marginally below the poll estimate of Rs 14,805 crore. On a year-on-year basis, revenue increased 15.9 percent.

Net profit for the period increased nearly 20 percent to Rs 2,616 crore, which turned out to be higher than the CNBC-TV18 poll of Rs 2,425 crore.

Operational performance also was largely in-line with expectations. EBITDA at Rs 3,377 crore increased 7.8 percent from last year, but was lower than the expectation of Rs 3,415 crore. Margin contracted 170 basis points from last year to 22.9 percent, but was only 20 basis points lower than the poll of 23.1 percent.

Gross margin for the HUL stood at 45.8 percent, which is a multi-quarter low.

The company's margin missed expectations despite a cut back in advertising and promotional expenses during the quarter. Overall A&P expense stood at Rs 1,041 crore compared to Rs 1,215 crore in September last year and Rs 1,328 crore during the June quarter. The management expects advertising expenses to ramp up amidst the festive season.

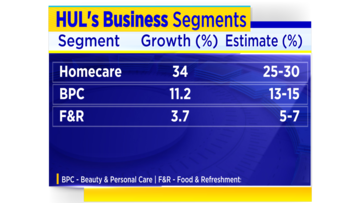

Among various business segments, the homecare business managed to outperform expectations while growth in Beauty & Personal care and Food & Refreshments turned out to be below what the street anticipated.

First Published: Oct 21, 2022 5:36 PM IST