Hindalco Industries posted its quarterly earnings for the April to June 2022 quarter last week with record-breaking profitability, but the company is concerned about the July to September period.

Satish Pai, managing director of Hindalco, expects cost pressure and low metal availability to hurt the margin of the firm’s aluminium upstream division. The current quarter may also be affected by the global macro environment, given the high interest rates in the US, where the aluminium maker has a subsidiary, Novelis, which has been driving its results.

Here is a look at Hindalco’s biggest worries

1. US interest rates

Novelis, the US subsidiary of

Hindalco, contributes the lion's share to its revenue. In its quarterly results exchange filing, the company said Novelis reported its best-ever quarterly EBITDA and EBITDA per tonne, primarily due to higher product pricing, favourable product mix and recycling benefits.

Pai believes the potential to do well always exists, but there are a few uncertainties as well, especially rate hikes in the US.

“Building and construction sector will get affected, and auto sales will slow down with the interest rates going up in the US. We have been cautious when we give that guidance,” he told CNBC-TV18.

He said the potential to surprise always is there, but the macro environment is a bit cloudy right now, especially in the US and Europe, and hence the firm has been a bit cautious with its guidance. The guidance had already been revised to $525 plus from earlier $500 plus for sustainable EBITDA per tonne.

2. Cost pressure

Pai pointed out that costs went up by 17 percent in the June quarter on a sequential basis and are expected to witness another increase in high-teens. E-auction premiums jumped nearly up to 500 percent in the June quarter but have come down to 300-250 percent now. The company hopes premiums will come down further as more coal becomes available, he told Moneycontrol.

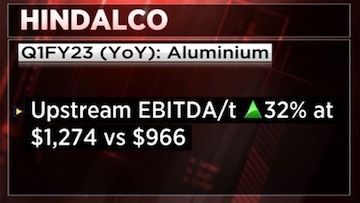

He believes the upstream margins will sharply contract in the second quarter of the financial year because coal costs went up, and the firm started to see the impact more towards the months of May-June.

“The full impact of the higher coal prices will be reflected in the July-September quarter,” he told CNBC-TV18.

Secondly, he pointed out that the average (London Metal Exchange) LME price of aluminium in June quarter was $2,800 per tonne.

In this quarter, it's running at $2,400 per tonne, so nearly $400 per tonne lower, he said on August 11. “So, you are going to see upstream

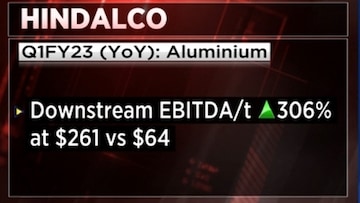

aluminium margin contracting in the September quarter, whereas we expect copper, Novelis and aluminium downstream to do very well, too,” he said.

Pai also said supply-demand fundamentals indicate aluminium prices could be higher than $2,400 per tonne. “It should be higher because inventories are at an all-time low, but there is a macro overhang. Is there or is there not going to be a recession in the US, will China economy pick up or not pick up — that is what is keeping the LME at the $2,400 level,” he said.

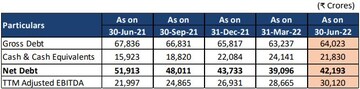

3. Debt

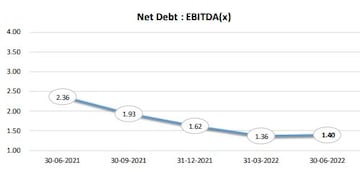

Hindalco’s consolidated net debt to EBITDA for June 2022 ended quarter came in at 1.40x compared to 2.36x as of June 30, 2021. Hindalco is targeting to keep this ratio below 1.5X.

(Debt/EBITDA—earnings before interest, taxes, depreciation, and amortisation—is a ratio measuring the amount of income generated and available to pay down debt before covering interest, taxes, depreciation, and amortisation expenses. Debt/EBITDA measures a company's ability to pay off its incurred debt, explains Investopedia.)

He is confident the company will be able to reduce its net debt every quarter.

“The gross debt level of Hindalco in India will go down because in June quarter we paid about Rs 4,000 crore of Rs 6,000 crore debenture, and we will be paying down another Rs 2,000 crore which we have already done in the first week of August. So, the gross debt in India will come down,” Pai said.

First Published: Aug 17, 2022 2:21 PM IST