Hero MotoCorp shares were under pressure on Friday as the two-wheeler major geared up for its financial results later in the day. Investors are expected to look out for commentary on demand and margin outlook at a time when automakers have taken a series of price hikes to protect profitability.

Hero MotoCorp will be reporting its earnings as auto manufacturers continue to struggle against higher raw material costs eating into their margins and supply-side issues on a persistent global shortage of semiconductors.

Analysts, however, believe the chip shortage does not impact Hero MotoCorp as much, given that it is a smaller player in the premium motorbike segment.

Analysts in a CNBC-TV18 poll expect Hero MotoCorp to report a net profit of Rs 771 crore for the April-June period, which would be more than double compared with the corresponding period a year ago.

They estimate its revenue to jump 56.6 percent year on year.

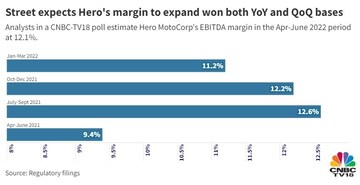

Analysts in the CNBC-TV18 poll peg Hero MotoCorp's margin at 12.1 percent, which would be 270 basis points above the year-ago period.

An expanding margin will be a big positive for the company at a time when businesses across sectors are scrambling to tackle their shrinking margins thanks to wild swings in commodity prices.

According to CLSA, the Hero MotoCorp management aims at taking the company's EBITDA margin to 14-16 percent by the year ending March 2024, from 11 percent in the quarter ended March 2022. EBITDA margin — a key measure of profitability — determines a company's operating profit as a percentage of its revenue.

Investors will also track the commentary on sales volumes. Hero MotoCorp took a price hike of up to Rs 3,000 with effect from July 1.

Hero MotoCorp shares have declined 3.7 percent in the past month, a period in which the benchmark Nifty50 has risen 10 percent.

First Published: Aug 12, 2022 12:33 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: All you need to know about EVMs and VVPAT; how they work

Apr 20, 2024 1:24 PM

Odisha Lok Sabha elections: Schedule, total seats, Congress candidates and more

Apr 20, 2024 11:39 AM

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM