A Mumbai-based IT consulting and outsourcing company is prepping for the impact of a recession that might hit the US economy at a time when the fear of a prolonged slowdown is gripping global markets.

A weakening rupee against the dollar is good news for India's tech sector. But IT firms would be in a tight spot in case there is a recession in the US and UK as they rely heavily on exports to the markets.

A firm with a plan

eClerx Services, an IT services management company, acknowledges that if there is a recession in geographies, the firm won’t be immune to it.

About 30 percent of the company’s business is discretionary and can be hurt by a recession, according to the firm’s Chief Financial Officer Nadadhur Srinivasan. “But about 70 percent non-discretionary business would keep the lights on,” Srinivasan told CNBC-TV18.

Meanwhile, there is no slowdown in orders yet and the firm’s pipeline is as strong as last year, except the base is higher this time because of which the growth in percentage terms will be lower than last year, the CFO said.

The IT service management company is eyeing double-digit growth and expects the earnings before interest, taxes, depreciation, and amortisation (EBIDTA) margin of 28-32 percent.

Srinivasan said eClerx had Rs 680 crore of cash on the books and the firm planned to return cash to shareholders. If the company doesn’t go for an acquisition, a buyback should be on the cards, he said.

| Quarter | Income from operations |

| Jan-Mar 2022 | Rs 591.67 crore |

| Oct-Dec 2021 | Rs 559.17 crore |

| July-Sept 2021 | Rs 523.25 crore |

| April-June 2021 | Rs 486.26 crore |

| Jan-Mar 2021 | Rs 472.82 crore |

The typical size of acquisition tends to be 10-12 percent of revenues, he said. “Buybacks have been the traditional form of returning cash to shareholders. Unless there is any inorganic requirement for that cash, given when we are allowed to have a second buyback, we will prefer to return part of the cash back,” he said.

eClerx top official’s remarks come at a time when the

pressure on Indian IT firms like Tata Consultancy Services (TCS), HCL Tech, Wipro, Infosys, and Tech Mahindra can already be seen on the Dalal Street. Investors are turning cautious on these stocks and experts have warned of more downside in the tech space on the Street.

The falling rupee doesn’t seem to be helping in the current scenario either as the sectoral index Nifty IT has fallen more than 6 percent in the past month.

eClerx shares were trading 1.3 % higher at Rs 1,909.05 at 1:50 pm on BSE.

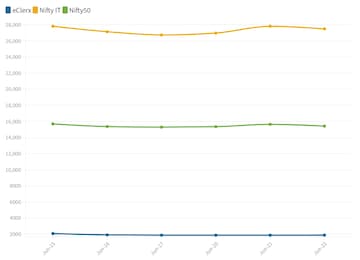

Here’s how the stock has performed over the past week:

Talent crunch

“In the discretionary part of the business, which is the analytics and automation service line, where skill requirements are higher, definitely there is a shortage of talent," Srinivasan said.

He said the company had to pay up for getting good talent. "On the non-discretionary part, which is largely operations-driven, our training and knowledge management helps us,” he said.

The CFO sees

attrition ramping down in the discretionary business and the pressures on hiring going down.

First Published: Jun 23, 2022 3:02 PM IST