Real estate giant DLF sold all 292 of its luxury residences in a Gurugram project, The Grove, for more than Rs 1,800 crore in just eight days, indicating demand is still robust despite rising home loan interest rates and property costs.

On September 26, DLF officially unveiled its "The Grove" project in Gurugram, Haryana's DLF phase-5.

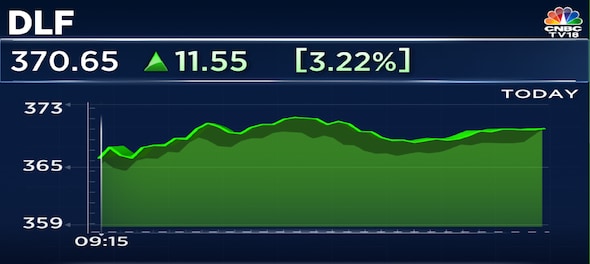

Following the sold-out news, shares of DLF Ltd climbed 3.12 percent from the previous close and are trading at Rs 369 on the BSE.

The company has advertised in leading newspapers that "'The Grove' is now sold out". The total sales revenue from this project is over Rs 1,800 crore.

Housing sales across all segments — affordable, mid-income, luxury and super luxury — have revived significantly after the second wave of the COVID pandemic.

"The new project will be a low-rise luxury development comprising 292 residences. The total developable area in this project is 8.5 lakh square feet," said Aakash Ohri, DLF Group Executive Director and Chief Business Officer.

Properties in DLF phase-5 have shown excellent appreciation in value as well as rentals. More than 50,000 residents already live in DLF5, which features 16 acclaimed premium, luxury and super-luxury residential communities, he added further.

On the overall sales bookings of DLF for the financial year 2022-23, he had said that the company has already given guidance of Rs 8,000 crore, and "we will stick to that".

What do analysts have to say?

Brokerage firm CLSA has a buy rating on DLF shares with a target price of Rs 470, implying a 28 percent upside from the closing price on October 4, 2022.

According to CLSA, DLF’s presales guidance of Rs 8,000 crore for the financial year 2023 has an upward bias. The firm estimates it to be higher at Rs 8,600 crore.

“We also believe the positive response may encourage DLF to upfront its launches to capitalize on demand momentum (the company has 16-17msf of base FAR in DLF5),” CLSA said in a note.

The brokerage firm added that the Delhi-NCR market has the most potential for DLF due to robust pent-up demand as DLF, with its strong brand, healthy balance sheet, and high-quality land bank, is best placed in this market.

The finances

In the April-June quarter, DLF's sales bookings doubled to Rs 2,040 crore from Rs 1,014 crore in the corresponding period a year ago. For 2021-22, DLF's sales bookings rose to Rs 7,273 crore compared to Rs 3,084 crore in the previous year.

In August, the company launched its new luxury housing project at Panchkula in Haryana and is targeting about Rs 1,300 crore in sales revenue from the Panchkula housing project. The company will develop 424 independent floors in this project.

DLF is India's largest real estate company in terms of market capitalisation. It has developed over 153 real estate projects covering 330 million square feet. The company has 215 million square feet of development potential across the residential and commercial segments.

The DLF Group has an annuity portfolio of over 40 million square feet. DLF is primarily engaged in the development and sale of residential properties (development business) and the development and leasing of commercial and retail properties (annuity business).

First Published: Oct 6, 2022 9:52 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP MP's wife challenges him in electoral battle for Etawah seat

Apr 25, 2024 9:39 AM

Lok Sabha Election 2024: Gurugram gears up for crucial polls amidst economic boom and civic woes

Apr 24, 2024 11:41 PM