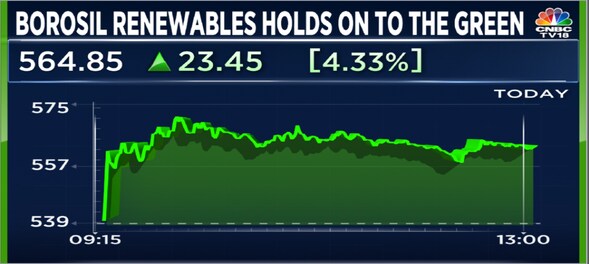

Borosil Renewables shares recovered some of the losses in the past three days on Tuesday, after an anti-dumping duty (ADD) on imports of certain glass products from China expired last week. An anti-dumping duty disincentivises imports in order to protect the domestic market from excessive supply, which in turn hurts prices.

Last Friday, the company informed the exchanges that the anti-dumping duty on textured tempered coated as well as uncoated glass lapsed after the completion of a five-year period.

A basic customs duty of 10 percent on solar glass is due for a renewal in March 2023.

Pradeep Kheruka, Executive Chairman at Borosil Renewables, tells CNBC-TV18 that the company expects the government to go for a regime of basic customs duty on imports of solar modules and cells. Borosil Renewables is a manufacturer of solar glass.

"There is already an existing 10 percent basic customs duty on import of solar glass, but this has been coming under an exemption that was granted in 1999. That's about 23 years ago. That exemption is supposed to lapse in March next year. Of course, nobody knows what the government is thinking, and I don't either, but there is a possibility that basic customs duty might be imposed," he said.

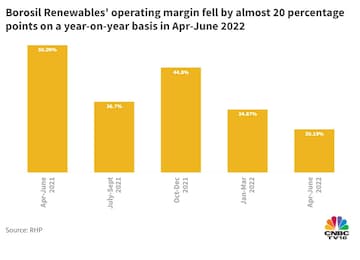

Borosil Renewables net profit slumped 24 percent in the April-June period to Rs 30.1 crore compared with the corresponding three months a year ago, according to a regulatory filing. The profit contracted even as its revenue jumped 24.9 percent to Rs 170 crore.

India Inc logged a mixed bag of earnings season amid persistent margin pressure emanating from a surge in raw material prices.

Borosil Renewables, for instance, took a big hit in terms of operating margin — a key measure of a business's earnings from its operating activities — in the three months to June 2022.

Kheruka expects the selling price to go down by up to 5-10 percent. "The imported glass coming from China will be cheaper is a given,” he said.

Borosil Renewables shares have shed 9.7 percent of their value in the past three months, a period in which the Nifty50 benchmark has rewarded investors with a return of eight percent.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM