Bata India on Friday said that school reopening aided the company's growth in the first quarter (Q1) of the financial year 2023 after it reported the highest ever quarterly sales — though slightly lower than estimates.

Bata India on Thursday reported its Q1 earnings, with the revenue from operations seeing an over three-fold jump to Rs 943.01 crore from Rs 267 crore in the pandemic-hit Q1 of FY22.

The consolidated net profit stood at Rs 119.37 crore, up 71.82 percent against Rs 69.47 crore during the same period last year. However, it was sharply lower than the CNBC-TV18 poll estimate of Rs 148 crore.

EBITDA, or earnings before interest, taxes, depreciation, and amortisation — a measure of the company's overall financial performance — at Rs 245 crore was higher than that in last year's Q1 but lower than the poll estimate of Rs 279 crore. EBITDA margin stood at 25.9 percent.

The company said that it had achieved about 90 percent of the 2019 levels in terms of volumes.

"We are seeing growth across all our channels. School has, of course, certainly aided that growth. We are at a school business, which is about 11 percent of our quarterly turnover," said Vidhya Srinivasan, CFO, Bata, in an interview with CNBC-TV18.

However, she added that the school business is yet to see full traction when compared to the pre-COVID levels and that the momentum is likely to continue in the second quarter.

Footfalls at retail stores and purchases through digital platforms rose sharply. The company said that the growth was aided by marketing investment and the ongoing increases in its portfolios. However, higher other expenses dented earnings.

Total expenses in Q1 stood at Rs 792.58 crore, up twofold as compared to Rs 371.61 crore a year ago.

"We have been increasing the number of stores. So, we're now up to 320. And that is something that we've talked about consistently. We want to get it to about 500," said Srinivasan.

"We are growing our speaker portfolio, we are opening sneaker studios, and that is again something where we are seeing... wherever we've done that, sneakers are performing extra, and therefore, we are more enthused to increase the penetration to sneaker studios over multiple stores," she added.

Bata stands by its target of sneakers being about 30 percent of its portfolio.

The company's product mix is changing and inching towards premiumisation, as a result of which, the price banding of a product range is also changing. As compared to 2019, the pre-COVID levels, the prices are up by 20 percent, it said.

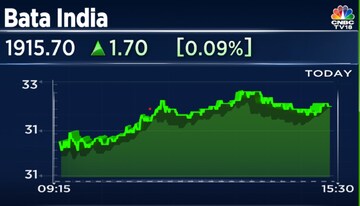

Bata stock was trading flat at Rs 1915 per share on BSE at the time of writing. It has gained over 6 percent in the last one month and is up 2 percent so far this year.

The CFO also said that as the company is moving away from retail to wholesale, there is expected to be some impact on the margin.

"On wholesale now, we are up to about 1,100 towns, and over 10,000 distributors. So, that is, again, consistent... wherever we implemented, we are seeing traction, both in terms of the top line and the bottom line. So, I think that is the trajectory we are on," she said.

First Published: Aug 12, 2022 12:29 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: From Wayanad to Shivamogga, key battles in the second phase

Apr 25, 2024 2:01 PM

EC probes allegations of MCC violation by Modi, Rahul; seeks response by April 29

Apr 25, 2024 1:32 PM

LS polls phase 2: Rahul Gandhi, Shashi Tharoor in fray; Hema Malini, Om Birla eyeing hat-trick

Apr 25, 2024 12:19 PM

UP constituencies to witness three-cornered fight in second phase tomorrow

Apr 25, 2024 10:47 AM