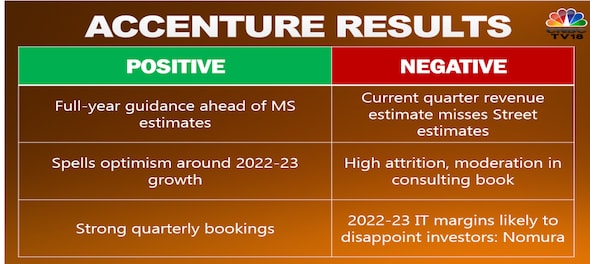

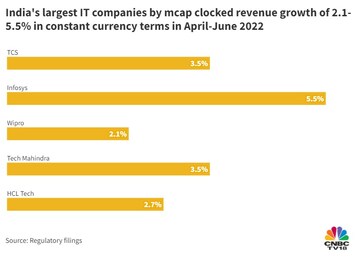

Accenture's quarterly performance has spelt a set of hits and misses for Indian software exporters, who continue to struggle against elevated levels of attrition and the consequent employee costs. This is eating into their margins despite robust demand and persistent weakness in the rupee against the dollar.

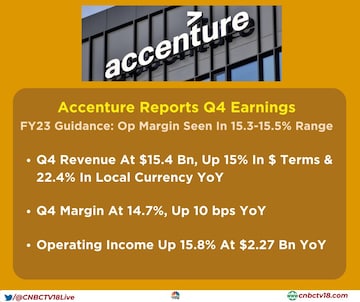

Accenture reported revenue growth of 15 percent for the June-August period, but hinted at a slide to 10-14 percent for the current quarter, which ends on November 30. The IT services firm uses a financial year that ends on August 31.

Its financial results come when IT remains one of the worst performing spaces on Dalal Street.

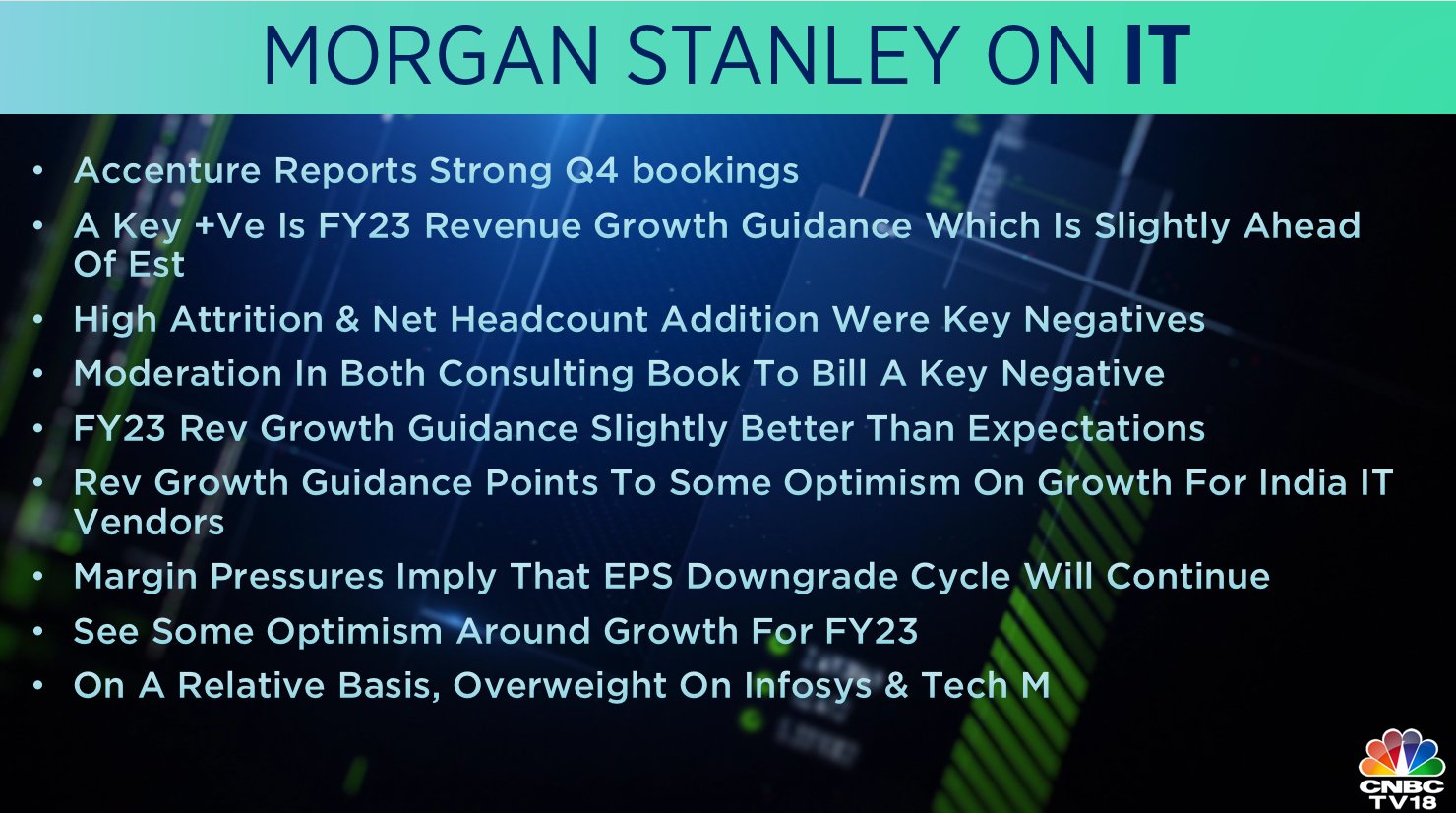

Accenture's full-year revenue guidance of 8-11 percent in local currency terms — for the year ending August 2023 — came ahead of Morgan Stanley's estimates, sharply lower than its actual growth of 26 percent for the year gone by

The brokerage believes high attrition levels and net headcount addition remain key negatives for the company.

Accenture expects its operating margin to come in at 15.3-15.5 percent for August 2023.

One should keep in mind that the last year was an exceptional one for Accenture, Sandip Agarwal, Research Analyst-Institutional Equities at Edelweiss Securities, told CNBC-TV18.

"There was a base effect as well, which will not get that benefit this year," he said.

He is confident that the IT industry will perform well for the next 2-3 years. "I don't have any doubt. And I don't read anything negative in the numbers. I think it is a good number, good guidance, and there is a lot of optimism, obviously with little caution," he added.

However, not every analyst on the Street is as optimistic.

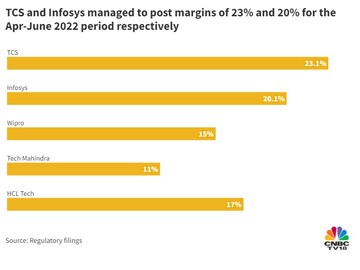

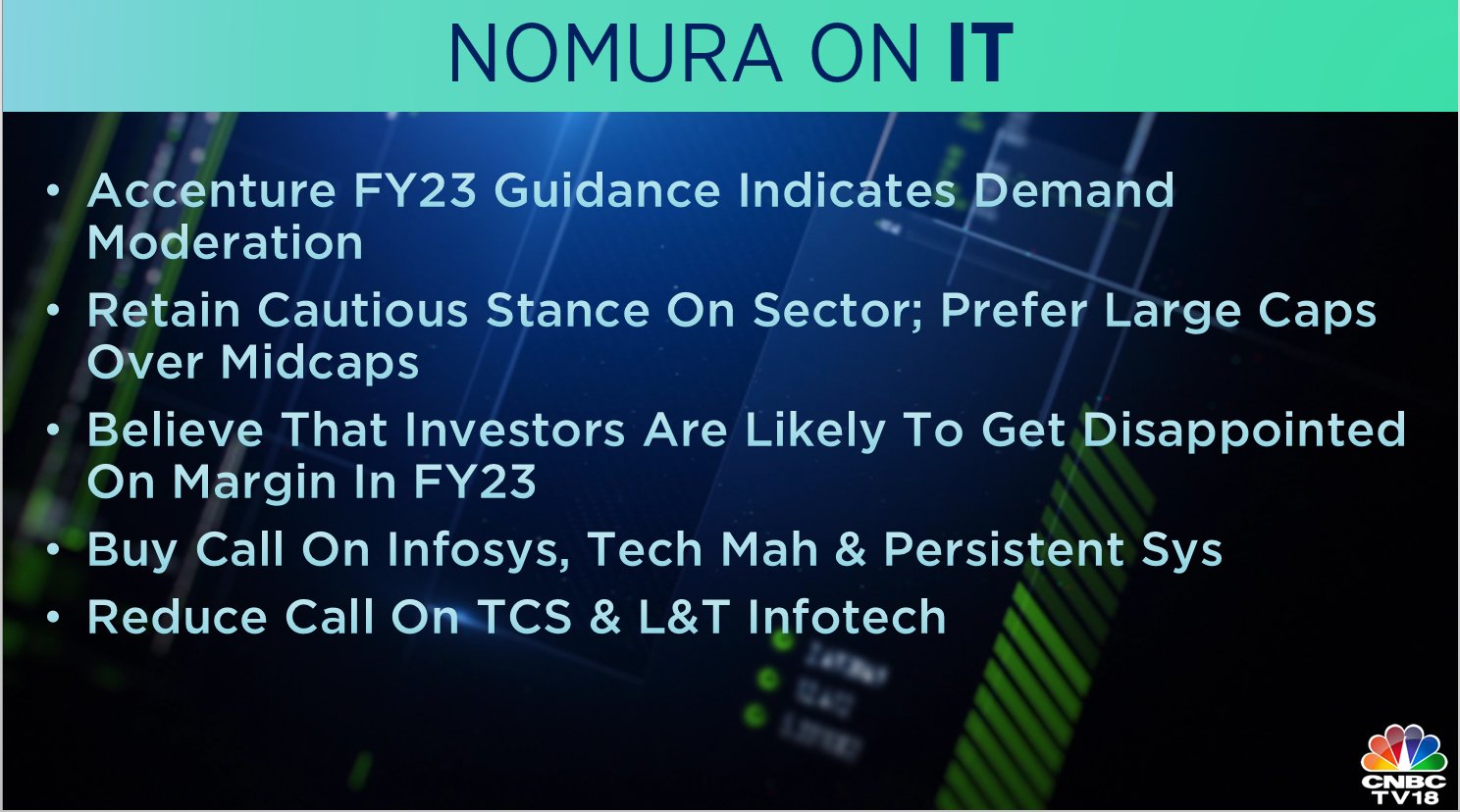

According to Nomura, Accenture's full-year revenue guidance suggests moderation in demand for the sector. It is of the view that IT margins are likely to disappoint investors in the year ending March 2023.

The brokerage has a 'buy' call each on Infosys, Tech Mahindra and Persistent, and a 'reduce' each on TCS and L&T Infotech.

Accenture's revenue guidance for the quarter ending November 2022 highlights the impact of lower IT spending — on account of sticky red-hot inflation — and a stronger dollar on the IT space.

Citi believes the outlook for the IT sector continues to worsen given the macro headwinds. The brokerage has a cautious stance on the sector though likes Infosys relatively.

Accenture typically starts a financial year with a weaker guidance and raises it gradually during the course of the year.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha election 2024: A SWOT analysis of DMK vs AIADMK in Tamil Nadu

Apr 19, 2024 1:22 AM

Exclusive: FM Nirmala Sitharaman says poverty alleviation can't be achieved by throwing money at the problem

Apr 18, 2024 7:27 PM

Tamil Nadu Lok Sabha elections 2024: List of Congress candidates

Apr 18, 2024 4:33 PM

Will the payment under PM-KISAN be increased? Here's what Finance Minister said

Apr 18, 2024 3:58 PM