The rupee has fallen about 12 percent so far in 2018, making it the worst-performing Asian currency this year.

The Indian currency has been under immense pressure due to the soaring global crude oil prices, which pose a serious threat to the country’s finances as India imports 80 percent of the crude oil it needs.

A weaker rupee makes imports expensive and exports cheaper in dollar terms. Indian airlines, which imports jet fuel from other countries, are therefore likely to face the heat of slump in local currency.

Why do forex changes matter for airlines?

For an airline with international operations such as Air India and Jet Airways, the need to translate cash flows into different currencies, and the uncertainty surrounding the level of future exchange rates, gives rise to the top risk. The size of the foreign exchange risk varies, depending on the nature and

scope of an airline’s operations, as well as its corporate strategy.

For airlines, the main foreign currency exposure is often to the US dollar because key cost items, notably fuel, maintenance, and overhaul costs, along with aircraft purchase and lease payments, are typically priced in US dollar terms.

How do forex changes affect airlines?

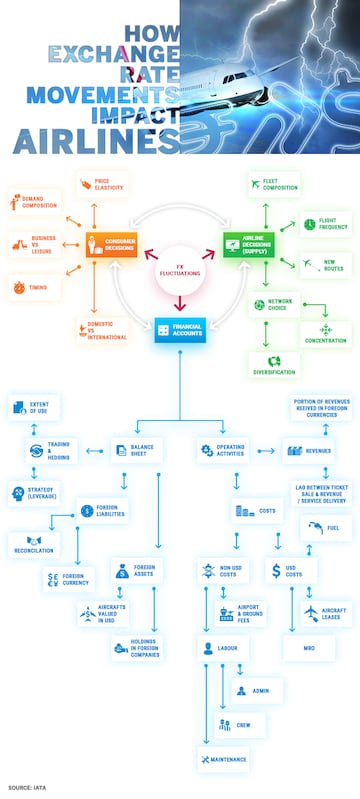

i) It affects consumer decisions when making travel plans. Lets take US-India travel route: With the current depreciation in rupee, a tourist planning to travel to India from the US will have to shell out less compared to what he/she might have ended up paying in January.

ii) Changes in exchange rates can also influence airline supply decisions. Airlines may be able to respond to relative price shifts by changing the gauge of aircraft on a particular route or via strategic cancellations. Again we'll take the top example: Now since more tourists based out of the US would be interested in travelling to India, airlines will have to ramp-up their capacity to accommodate more travelers.

iii) Exchange rate fluctuations can also impact airline finances, both day-to-day operating activities (profitability) and balance sheet valuations.

Which is the biggest forex risk for the airlines?

The financial impact can be especially acute for airlines when it relates to sizeable changes in the value of the US dollar. This is because a large proportion of airline costs (including fuel) are denominated in US dollars, and many carriers need to convert domestic currency into dollars each

year to meet their obligations. This gives rise to FX risk.

Why can't airlines pay bills in their local currency?

To compare and to aggregate the financial performance of the global airline industry, individual airlines’ local currency financial results must be converted into a common, comparable currency.

As in many other industries, typically the US dollar is used for this purpose. As a result, changes in the value of the US dollar can distort comparisons for a variety of variables, including yields, fares and revenues. Specifically, a stronger US dollar places downward pressure on non-US financial

results when converting into US dollar-terms, as each unit in local currency terms is now worth less when expressed in US dollar terms.

(With inputs from IATA report)

Have you signed up for Primo, our daily newsletter? It has all the stories and data on the market, business, economy and tech that you need to know.

First Published: Sept 18, 2018 7:05 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Nearly 26,000 teachers lose their job in Bengal — it may be significant turn in the Lok Sabha election

Apr 22, 2024 11:58 PM

Lok Sabha Elections phase 2: Battle of "guarantees" in Karnataka

Apr 22, 2024 11:15 PM

'First lotus to PM Modi' as BJP nominee Mukesh Dalal elected unopposed, says state chief

Apr 22, 2024 3:43 PM

Deepfakes of Bollywood stars spark worries of AI meddling in India election

Apr 22, 2024 12:33 PM