Total vehicle retail sales increased 27 percent year-on-year (YoY) in June with all categories — two-wheelers, three-wheelers, commercial vehicles, tractors and passenger vehicles — in the green, the data released by the Federation of Automobile Dealers Associations (FADA) on Tuesday showed.

While the two-wheeler retail sales went up by 20 percent YoY, commercial vehicle, passenger vehicle and tractor sales increased by 89 percent, 40 percent and 10 percent, respectively. The three-wheeler sales saw the highest jump of 212 percent.

However, as compared to June 2019, the pre-COVID period, the overall sales were still down by 9 percent. Among categories, the two-wheeler space remains as the biggest cause of concern as it is down by 16 percent compared to the pre-COVID levels.

Commercial vehicle sales for the first time showed signs of recovery as they are up 4 percent compared to June 2019 while three-wheelers narrowed their de-growth to -6 percent.

Passenger vehicles and tractors, which were already above pre-COVID level for last few months, grew by 27 percent and 40 percent.

"Though few categories are consistently showing recovery, full recovery is yet to be witnessed when compared to pre-COVID times," said FADA.

Source: FADA

Overall sales in the first quarter of the current financial year grew by 64 percent when compared to the same period last year which saw intermittent

lockdowns. However, compared to Q1 FY20, the sales were down by 8 percent.

"Only PVs and tractors were in green for the entire quarter," it said.

FADA added that the increased wholesale reflected ease in semi-conductor availability thus reducing supply side constraints going ahead but high inflationary pressure was major concern.

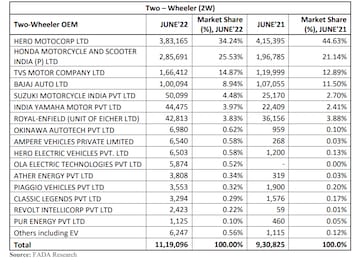

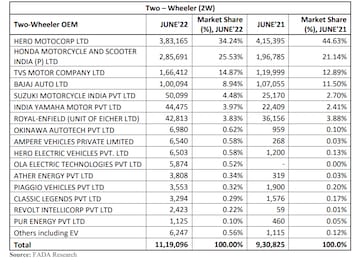

Among two-wheeler players, Hero MotoCorp's market share came down from 44.6 percent in June 2021 to 34 percent in June 2022. It sold 3.83 lakh units last month compared to 4.15 lakh units in June 2021. However, the market share has improved from the March 2022 levels of 32.27 percent.

"Hero MotoCorp has been impacted due to continuous stress on entry level segment," Vinkesh Gulati, President, FADA, told CNBC-TV18.

Honda Motorcycle and Scooter India had the second highest market share at 25.5 percent in June 2022. It was 21 percent during the same period last year. TVS, Suzuki Motorcycle and Yamaha have also marginally increased their market share.

Source: FADA

Among electric vehicle companies, Ola Electric reported a drop in sales on a month-on-month basis. It sold 5,874 vehicles in June 2022 compared to 9,225 in May and 12,691 in April.

"No doubt the demand (for two-wheelers) has gone down because of a lot of factors like inflation, rural distress... but the EV growth is phenomenal," said Gulati.

Gulati said that electric vehicle players are eating up into the market share of Internal Combustion Engine (ICE) auto companies. This will lead to established players increasing their EV production or launching more products, he added.

While customer confidence on EVs was a bit shaken due to the recent fire incidents, Gulati expects the demand for these vehicles to start picking up in a few months.

The passenger vehicle segment is also likely to see a good period in coming months owing to new launches, he said, adding that three-wheeler sales will see increasing adoption of EVs.

Commercial vehicles and tractors will continue showing a positive trend, according to the FADA president.

First Published: Jul 5, 2022 2:46 PM IST

Source: FADA

Source: FADA Source: FADA

Source: FADA