With the surge in raw material costs and a subdued demand environment, investors are posed with questions of whether this is the right time to bottom-fish tyre stocks and why?

Some believe that the sharp run-up in input costs has dimmed the margin outlook for tyre companies, which means, for now, one could avoid betting on tyre stocks.

| Companies | Correction in 2022 so far | |

| 1 | JK Tyre | 29% |

| 2 | CEAT | 25% |

| 3 | TVS Srichakra | 20% |

| 4 | Apollo Tyres | 19% |

| 5 | MRF | 9% |

| 6 | Balkrishna Industries | 9% |

Kotak Institutional Equities believes this is not the right time to bottom fish and has slashed its target price for Apollo Tyres, CEAT, and MRF as higher raw material costs and inadequate price hikes have led to a cut in the brokerage firm’s operating margin estimates for these stocks.

Higher finance cost assumptions, due to an increase in interest rates, are among other reasons for the brokerage firm’s view.

“We believe escalating RM (raw material) prices along with subdued demand in the replacement segment will continue to put pressure on profitability,” the domestic brokerage firm said in a note to clients.

Higher input costs

The most important raw material used in tyres is natural rubber. As per a report, tyre manufacturing accounts for 70 percent of the world's natural rubber production.

Also Read | US expects upcoming earnings season to be rocky

The supply of natural rubber is expected to remain tight in the coming months as most rubber-producing countries enter the off-tapping season, according to Kotak Institutional Equities. Tapping is the process by which the rubber is collected from a rubber tree.

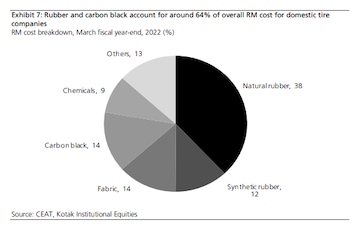

According to the brokerage firm, synthetic rubber, carbon black, and chemicals form around 40 percent of the raw material basket. Prices for these are derived from crude oil, and over the past two quarters, Brent crude prices have almost doubled amid the Russia-Ukraine conflict.

Further, competitiveness has increased with the market leader adopting an aggressive pricing strategy in select segments, which has made it difficult for the industry to recover the raw material price inflation, the domestic brokerage firm pointed out.

| Companies | Rating downgrades | Target price | |

| 1 | Apollo Tyres | ‘Reduce’ from ‘Add’ | Cut to Rs 175 from Rs 225 |

| 2 | CEAT | 'Sell' from 'Reduce' | Cut to Rs 850 from Rs 1,000 |

| 3 | MRF | Maintained 'Sell' | Cut to Rs 55,000 from Rs 61,500 |

Also Read | This smallcap drilling firm's stock has beaten Coal India, ONGC and Oil India's returns by 10 times

Going for the longer term

Meanwhile, there is a section of the market that believes that good companies are available at a discounted price right now, implying one could put money in tyre stocks for the long haul.

"Apollo Tyres and Balkrishna Industries are seen as good investment bets from a long-term perspective where the horizon is about 3-5 years," said Koushik Mohan, a fund manager at Moat PMS.

“Because of the current market conditions, it is difficult to generate performance. But in the long run, make sure to buy a big fishing net and catch them as much as possible. Short-run in commodities prices is the big reason for the stocks to underperform, but this is the time to fish them for the long term,” Koushik said.

He believes the entire tyre sector is at a discount as compared to their three-year forward PE (Price to earnings). However, in the short run, Mohan said one should avoid investing in tyre stocks.

Yet there are some tyre manufacturers like Goodyear India that have recommended Rs 20 dividend and Rs 80 special dividend, subject to approvals. This means the tyre company has announced a 200 percent dividend and an 800 percent special dividend. What this could essentially mean is there are still some stocks in the sector that could prove to be a decent bet.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: Star Chandru, DK Suresh, Hema Malini among richest candidates in second phase

Apr 24, 2024 5:18 PM

Pannian Ravindran: Thiruvananthapuram's Left candidate who's lived in party office for 40 years

Apr 24, 2024 11:47 AM