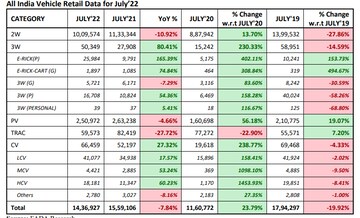

Total vehicle retail sales decline by 8 percent year-on-year (YoY) in July with three-wheelers and commercial vehicles (CV) the only segments that saw a growth, the data released by the Federation of Automobile Dealers Associations (FADA) on Thursday showed.

The total retail sales in July were at 14,36,927 units against 15,59,106 units during the same month last year.

While the three-wheeler and commercial vehicle retail sales grew 80 percent and 27 percent, respectively, two-wheelers, passenger vehicles (PV) and tractors saw a decline in sales by 11 percent, 5 percent and 28 percent, respectively.

As compared with July 2019, the pre-COVID period, total vehicle retails are down 20 percent. Passenger vehicles and tractors continued to outperform by growing 19 percent and 7 percent. All other categories are in the red with two-wheelers, three-wheelers and commercial vehicles falling by 28 percent, 15 percent and 4 percent, respectively.

Source: FADA

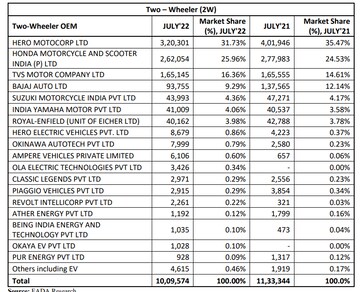

Source: FADAAmong two-wheelers, Hero MotoCorp's market share dropped from 35.47 percent in July 2021 to 31.73 percent last month. It sold 3,20,301 units against 4,01,946 units last year in July. However, it continues to lead the two-wheeler market.

"Hero MotoCorp has been impacted due to continuous stress on entry level segment," Vinkesh Gulati, President, FADA, had told CNBC-TV18 last month.

Honda Motorcycle and Scooter India's market share grew marginally from 24.53 percent in July 2021 to 25.96 percent. TVS, Suzuki Motorcycle and Yamaha have also marginally increased their market share.

Source: FADA

Source: FADA"The 2W retail run witnessed poor demand as Rural India continues to underperform. This coupled with high inflation, erratic monsoon and high cost of ownership continues to keep bottom of the pyramid customers at bay.

The 3W space continued to see demand recovery even though full recovery to pre-Covid levels is still some time away," said FADA, adding that July is generally considered as a lean month before festival season hits in August.

CV retail figures continue to witness good demand as the government’s infrastructure push is helping customers while the PV segment is witnessing a dream run, according to FADA.

However, with the risk of US-China-Taiwan tussle, threat of semi-conductor shortage is once again looming, it added.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM