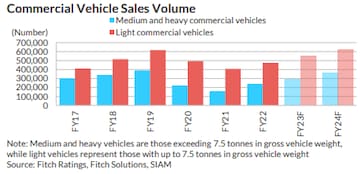

India's commercial vehicle (CV) sales volume shall grow in the mid-to high-teens over the next few years after recovering 26 percent in the financial year ending March 2022, financial services company Fitch Ratings said in a report on Wednesday.

A recovery in medium and heavy CVs (MHCV) from multi-year lows, along with sustained growth in light CV (LCV) categories, will help overall CV volume reach close to one million units by FY24 – the level of the last cyclical peak recorded in FY19, according to the report.

Growth in the passenger CV category, which experienced a sharper pandemic impact due to travel restrictions and the suspension of school and office commutes, will also aid growth, despite its smaller share of below 15 percent of overall CV volume before the pandemic.

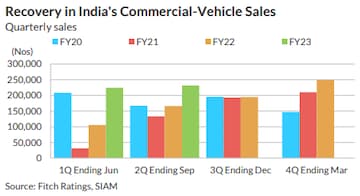

In the first six months of 2022-2023 fiscal, Indian automakers have sold a total of 456,199 units, of which 231,880 were sold in the second quarter, as per data released by the Society of Indian Automobile Manufacturers (SIAM) earlier in October.

Also Read | October auto sales: Passenger vehicles see strong growth, 2W purchases decline — see how auto firms fared

SIAM Director General Rajesh Menon noted that the commercial vehicle segment has started showing trends of better market demand. Reflecting on quarterly sales, Vinod Aggarwal, President of SIAM, added, "There is an improvement seen across the segments in Q2 of 2022-23, compared to the previous year." He also pointed to the recent increase in the prices of CNG fuel, higher repo rates, and the Russia-Ukraine conflict as concerns that could impact the market in the coming months.

Fitch also noted that replacement demand for the CV segment remained muted in the past few years, as multiple challenges affected purchase decisions, despite rising fleet age. These included excess systemwide capacity following revised axle load norms, increased vehicle costs following the adoption of more stringent BS6 emission norms and weaker financing availability.

However, in its latest report, Fitch has listed a range of factors likely to lead to sustained recovery of the commercial vehicles segment. Here's a look

–A rapid recovery in India's economic activity levels after the pandemic shock and the government's planned increase in infrastructure spending will help sustain an improvement in fleet utilisation rates, supporting freight economics for operators. This should support the revival of the replacement cycle, notwithstanding pressure from high inflation and a rise in borrowing rates since the start of the Russia-Ukraine war, the report said.

–It added that high fuel rates would also spur the replacement of older CVs with new, more energy-efficient vehicles, including those with compressed natural gas drivetrains in the smaller categories.

–Eased travel curbs and the resumption of physical attendance at offices and schools will support a rapid volume recovery in the passenger (bus) segment of MHCVs after an outsized pandemic caused FY22 volume to remain 70 percent below the pre-pandemic level in FY19. The report said that passenger MHCV volume in the first half of FY23 grew by more than five times from a year ago and was 30 percent higher than sales volume in the entire year FY22.

–"We believe growing loan disbursements by CV financiers will bolster sales over the medium term. Improving earnings visibility for fleet operators, along with manageable asset quality and funding access for lenders, should underpin improved credit availability," Fitch said.

–Recovering economic activity levels and higher infrastructure spending under the government's budget have supported improved CV utilisation rates. This is evident from rising freight rates and fleet operators' improving profitability since 1HFY22.

Also Read | Maruti entering a sweet spot in new SUV launches but PV industry growth to be slow: Analysts

Fitch explained that most fleet operators chose to defer the purchase of new CVs, given various challenges since 2018 that weighed on fleet utilisation rates and profitability. This caused a stagnant population of active CVs since FY19. "The average age of vehicles also rose to multi-year highs, typically associated with lower fuel efficiency," it said.

However, the factors mentioned above, along with improved financing availability, have lifted buying sentiment in recent quarters, spurring the revival of replacement demand. This is despite the increased cost of ownership due to a rise in fuel and commodity prices and an uptick in borrowing rates after the start of the Russia-Ukraine war, the ratings agency noted.

"This should support sustained demand momentum over the next few years. We estimate sales of around 500,000 units in deferred replacements from past years, particularly given lower fuel efficiency associated with the ageing fleet," it added.

It credited robust gains in sales share of compressed natural gas variants in the intermediate and small categories, which offer higher fuel cost efficiency than conventional diesel variants, for its view.

Such variants contributed 40 percent of Tata Motors's –India's leading CV maker – sales in the intermediate category in FY22, up from 20 percent a year ago, it added.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Gurugram gears up for crucial polls amidst economic boom and civic woes

Apr 24, 2024 11:41 PM

Lok Sabha Election 2024: Crucial seats up for grabs as Rajasthan, Maharashtra, Bihar gear up for 2nd phase of polls

Apr 24, 2024 11:40 PM