Monthly sales numbers from major auto manufacturers on Friday mostly indicated that demand in the sector is improving, after months of high input cost eating into their profits due to an increase in commodity prices and persistent supply-side issues.

Total sales of Tata Motors, Bajaj Auto and Ashok Leyland in June exceeded Street estimates, rekindling hopes of a rebound in the space, though those of Maruti Suzuki fell short of expectations.

Maruti Suzuki sold a total of 1.3 lakh vehicles in the domestic market, up 1.3 percent on a year-on-year basis, according to a regulatory filing. Its total sales, however fell 5.8 percent to 1.55 lakh vehicles, missing the Street estimate of 1.61 lakh.

| Company | June sales | Nomura estimate |

| Maruti Suzuki | 1.55 lakh | 1.61 lakh |

| Tata Motors | 82,462 | 77,900 |

| Ashok Leyland | 14,531 | 13,200 |

| Bajaj Auto | 3.47 Lakh | 3.21 Lakh |

Maruti — the country's largest carmaker — said it took took all possible measures to minimise the impact of the shortage of electronic components on its production. The auto major reported its highest exports for any quarter.

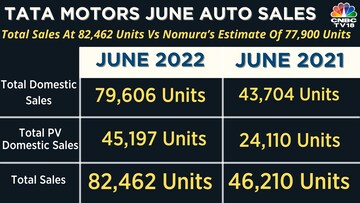

Tata Motors reported a 78.4 percent increase in total sales last month, exceeding Nomura’s estimate of 77,900 vehicles. The sales of its passenger vehicles in the domestic market jumped 87 percent to 45,197 vehicles, according to a filing.

The Tata group auto giant sold a total of 3,507 electric vehicles during the month — a jump of more than five times on year.

Maruti Suzuki, Tata Motors, Bajaj Auto, Ashok Leyland and Eicher shares fell 1-3 percent in afternoon deals on Friday. Mahindra & Mahindra and Hero MotoCorp eked out small gains.

| Stock | Change (%) | One-week return (%) | One-month return (%) |

| Bajaj Auto | -2.6 | -5.2 | -2.8 |

| Tata Motors | -0.8 | -0.2 | -8.1 |

| Maruti Suzuki | -1.7 | -0.4 | 5 |

| Ashok Leyland | -1.5 | 3.9 | 4 |

| Hero MotoCorp | 0.3 | -1 | -1 |

| TVS | -0.8 | 4.7 | 13.5 |

| Escorts | -0.2 | -5.1 | -9.6 |

| Mahindra & Mahindra | 0.2 | 2.3 | 4.6 |

| Eicher | -1 | -3.9 | 0 |

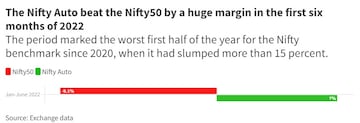

Most auto stocks have been declining for the past few weeks after months of outperformance in a market struggling against aggressive hikes in pandemic-era interest rates and their impact on economic growth.

Bajaj Auto reported total domestic sales of 1.38 lakh vehicles — a decline of 15 percent on a year-on-year basis. Its exports, however, increased 13 percent on year to 2.08 lakh vehicles, according to a regulatory filing.

The two-wheeler major's total sales — those in the domestic as well as foreign markets — came in at 3.47 lakh vehicles, exceeding Nomura's estimate of 3.21 lakh.

Commercial vehicle major Ashok Leyland's total sales jumped more than two times to 14,531 vehicles in June, from 6,448 vehicles in the corresponding period a year ago, according to a regulatory filing. Its total sales came in at 14,531 vehicles, ahead of the brokerage's estimate of 13,200 vehicles.

Eicher Motors — a manufacturer of commercial vehicles and Royal Enfield brand motorcycles — reported a more than three-fold jump in domestic commercial vehicle sales to 5,584 vehicles. It sold a total of 6,185 trucks and buses last month, as against 2,370 in June 2021.

Strong demand for automobiles

Analysts are positive on the demand prospects for the sector in the coming months given the easing of input costs and the chip shortage.

"Raw material costs have cooled down which are likely to positively surprise on the margin front. Auto has been the best performing sector this year, with M&M and TVS Motors hitting all-time highs... The sector is likely to see huge demand with the chip problem getting resolved," AK Prabhakar, Head of Research at IDBI Capital Markets, told CNBCTV18.com.

He recommends using any dip in M&M, Maruti Suzuki and TVS Motor Company stocks as a buying opportunity.

Hike in prices of commercial vehicles

Meanwhile, a hike in the prices of Hero MotoCorp vehicles and Tata Motors commercial vehicles came into effect on Friday.

"The slowdown is looking real both in terms of high frequency data and ground-level checks, which is what a lot of brokerages are doing and commodities are the first to get impacted... The price action can be extremely sharp," Gurmeet Chadha, Managing Partner and CIO at Complete Circle Consultants, told CNBC-TV18.

He is of the view that it is time to be contrarian in spaces such as automobiles which are the worst hit due to volatility in commodities.

(Edited by : Sandeep Singh)