If you thought electric vehicles are the panacea for a green planet, think again. But there’s money to be made from the EV shift.

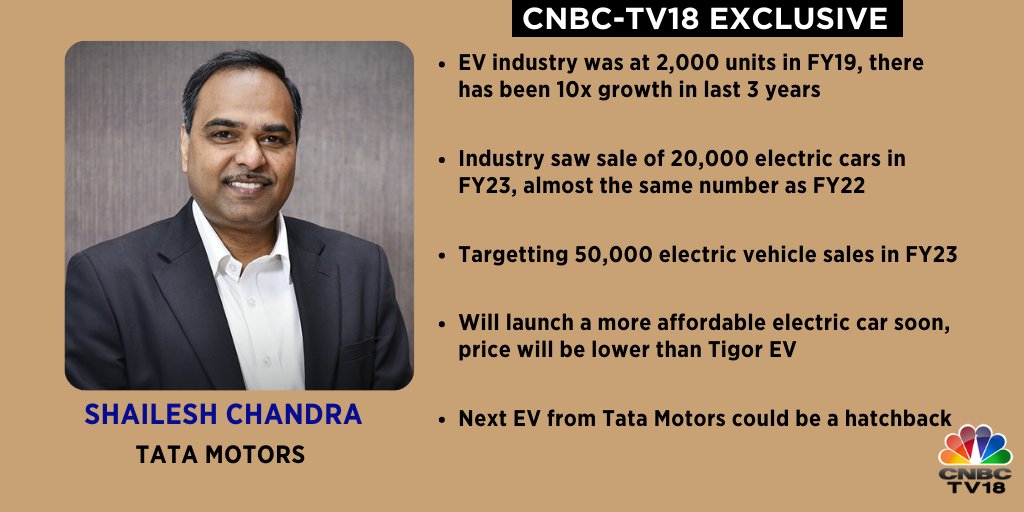

Electric vehicles are estimated by the International Energy Agency (IEA) to be a $53 trillion to $82 trillion opportunity (based on two scenarios) by 2050. That isn’t small change. It also explains why many Indian automakers are pulling out all stops to establish their presence in the segment — Mahindra & Mahindra unveiled its first electric SUV ahead of World EV Day, and Tata Motors told CNBC-TV18 it was looking to launch a low-cost EV car for the masses.

A rapid expansion in EV volumes is required to replace the existing stock of gasoline-/diesel-powered vehicles, and this is expected significant pressure on the world’s resources till we get to a stage of near 100 percent EV mobility, following which recycling of material can diminish demand for such materials. To give you a sense of where things stand, the world today is estimated to have about 1.446 billion cars and that’s for a population of 8 billion people, suggesting a ratio of 180 cars per 1,000 people. That’s set to grow as world population grows to near 9 billion and incomes rise with economic growth by 2050 (as per World Energy Council).

For context, EV sales of 6.6 million vehicles in 2021 was just over 9 percent of global passenger vehicle sales and this took the total number of EVs on the road to near 16.5 million. While this is a huge leap from the 1,20,000 numbers sold in 2018, it just indicates the huge replacement potential when seen in context of the total personal vehicles on the roads. EVs and its ecosystem are thus a big business growth opportunity, and not surprisingly private investors are betting big on the infrastructure play as well, Tata Power’s recent deal in renewables is a case in point.

EV DOESN’T SPELL ALL GREEN

California in the US is the state that sees the highest sales of cars. The state recently took a decision to phase out sales of all gasoline-fired vehicles by 2035. Ironically, therefore, its recent missive to residents not to charge their vehicles on the Labor Day weekend evenings, when electricity demand peaks and solar energy supply dips, invited more than a few jibes. Residents weren’t amused at being incentivised to shift to EVs and then having to curb their power consumption.

The incident, while not a derailer of the EV shift, did bring to the fore the harsh reality of EVs. Their batteries need to be charged with electricity from power plants that aren’t all run on green energy. In fact, IEA sees renewables accounting for only 27 percent of global energy mix by 2050. This even as electricity demand from EVs can scale to 8855 TWh in 2050, accounting for near 20 percent of total power consumption.

Then there’s the materials need, which is seen exerting pressure to dig up more of our planet. According to IDTechEx, “while the combustion engine and transmission relies heavily on aluminium and steel alloys, Li-ion batteries alone also require a great deal of nickel, cobalt, aluminium, lithium, copper, insulation and thermal interface materials”. And this is seen exerting significant pressure on resources like cobalt (till alternative technologies emerge), where there’s already talk of a “cobalt cliff”. Mining as we know it, comes with its ills, and with much of the resources in Africa and South America, the rush for materials won’t necessarily be a great societal boon. Some reports suggest the nature of resource demand can also shift the balance for energy needs from West Asia to China (that provides many of the inputs for EVs), and that could be another geopolitical worry.

There will also be need for a lot of crude-based polymers and materials for battery packing that isn’t going to diminish the demand for fossil oil, though less will be consumed as primary fuel.

A McKinsey report of 2018 had sought to dispel the myth. “Having more electric and hybrid vehicles on the road is expected to reduce oil demand only modestly over the next 10 to 15 years,” it observed. Even as it pointed to the increased demand for electricity being largely serviced through greater use of natural gas.

DON’T BUY AN EV ONLY TO BE GREEN

The McKinsey report suggests that most consumers base their decision to buy an EV on “wanting to help the environment”. And that thesis is shaky. McKinsey adds: “Our research reveals that several common assumptions about EVs and the Earth’s resources are misplaced. And in some cases, the common wisdom is almost entirely wrong”.

So, the next time you think about buying an EV only for helping the planet, think again. Buying stocks to play the big EV opportunity is another matter altogether.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM